In the age of digital, where screens rule our lives, the charm of tangible printed products hasn't decreased. In the case of educational materials such as creative projects or simply to add an individual touch to the space, What Is Input And Output Tax are now a useful resource. In this article, we'll take a dive deep into the realm of "What Is Input And Output Tax," exploring what they are, how they are, and how they can enrich various aspects of your lives.

Get Latest What Is Input And Output Tax Below

What Is Input And Output Tax

What Is Input And Output Tax - What Is Input And Output Tax, What Is Input And Output Tax Credit, What Is Input And Output Tax In Gst, What Is Input And Output Tax In Sap, What Is Input And Output Sales Tax, What Is Input Tax And Output Tax In The Philippines, What Is Input And Output Vat, What Is Input And Output Vat In South Africa, What Is Input And Output Vat Uk, What Does Input And Output Tax Mean

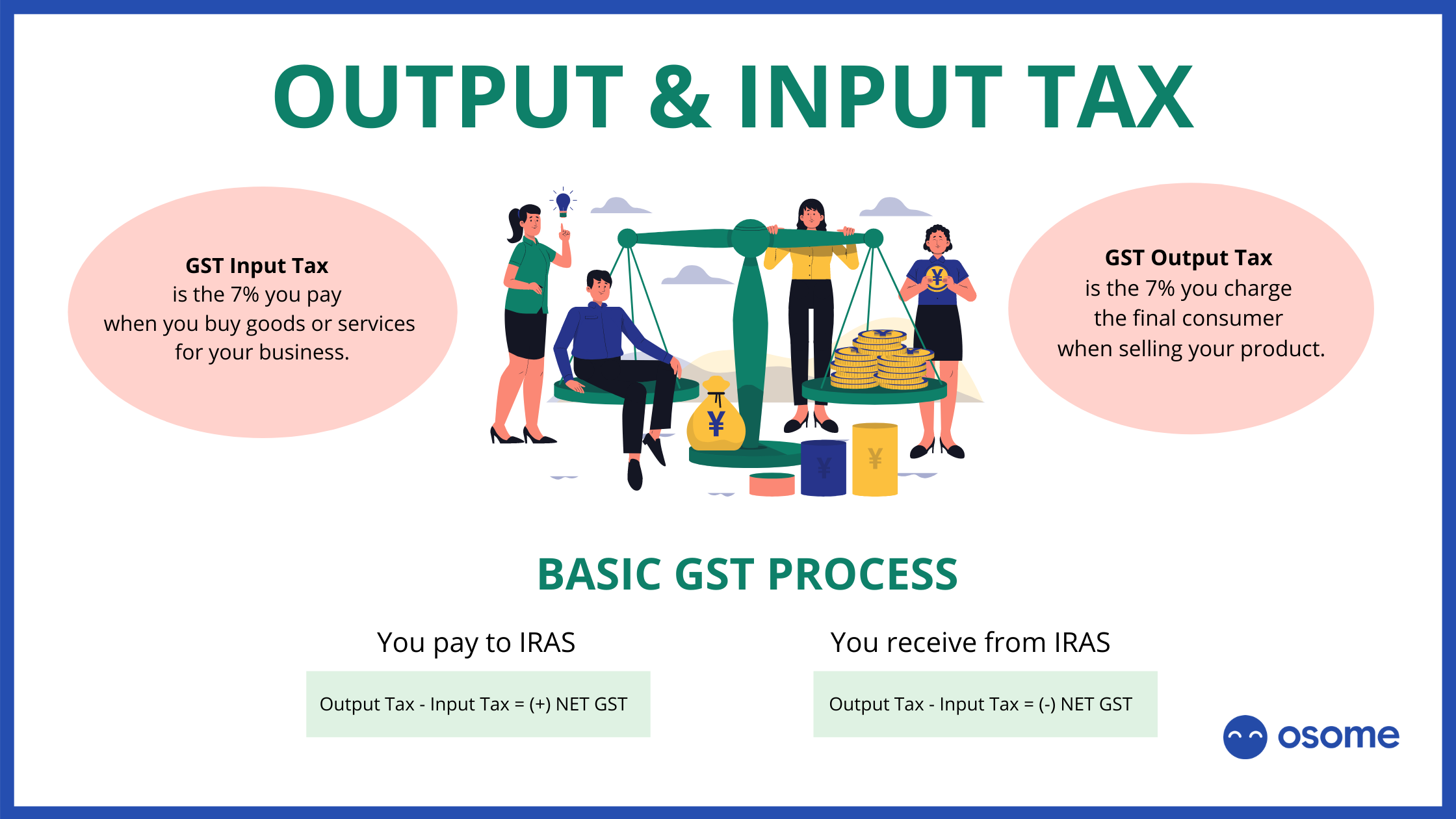

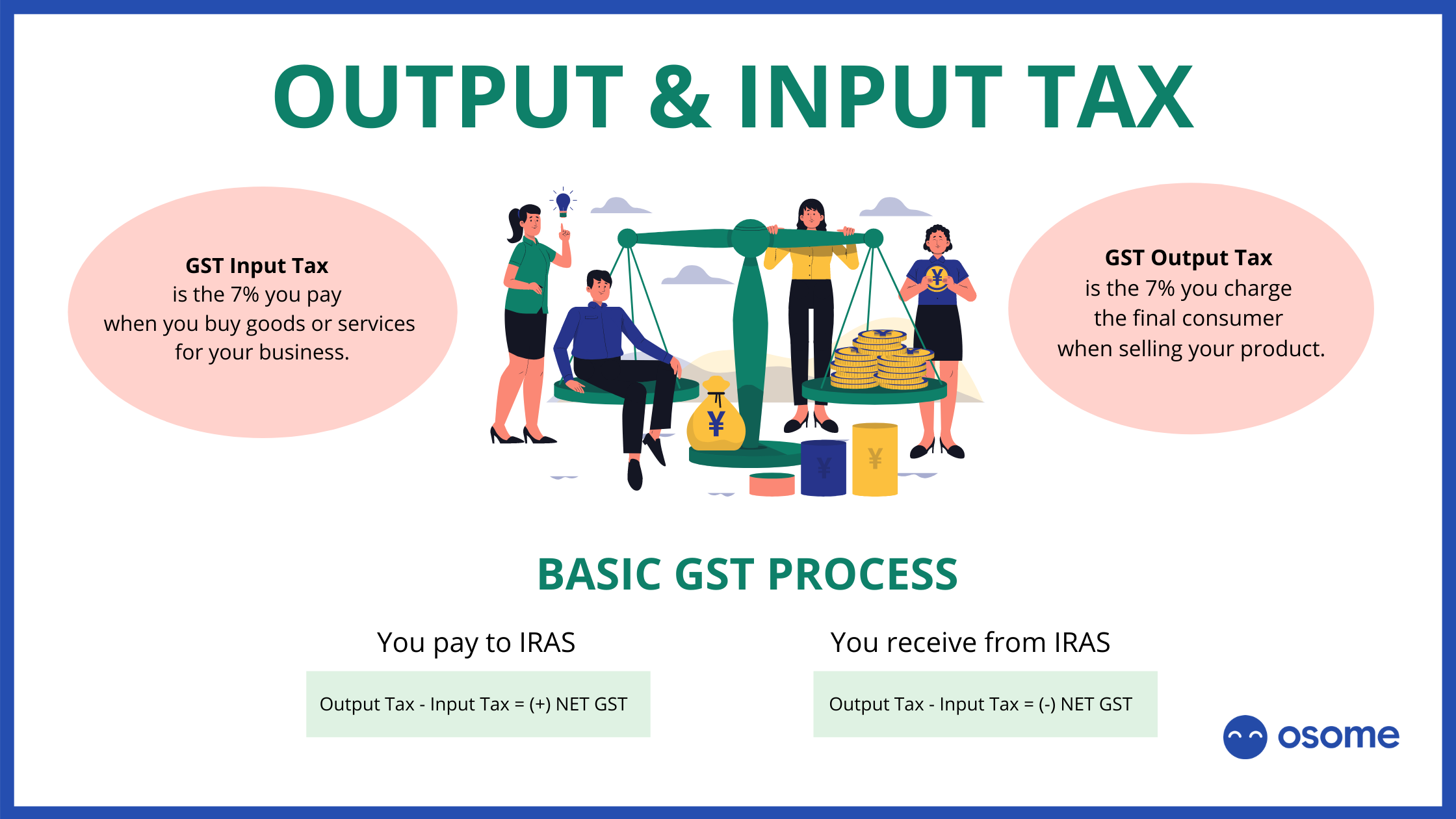

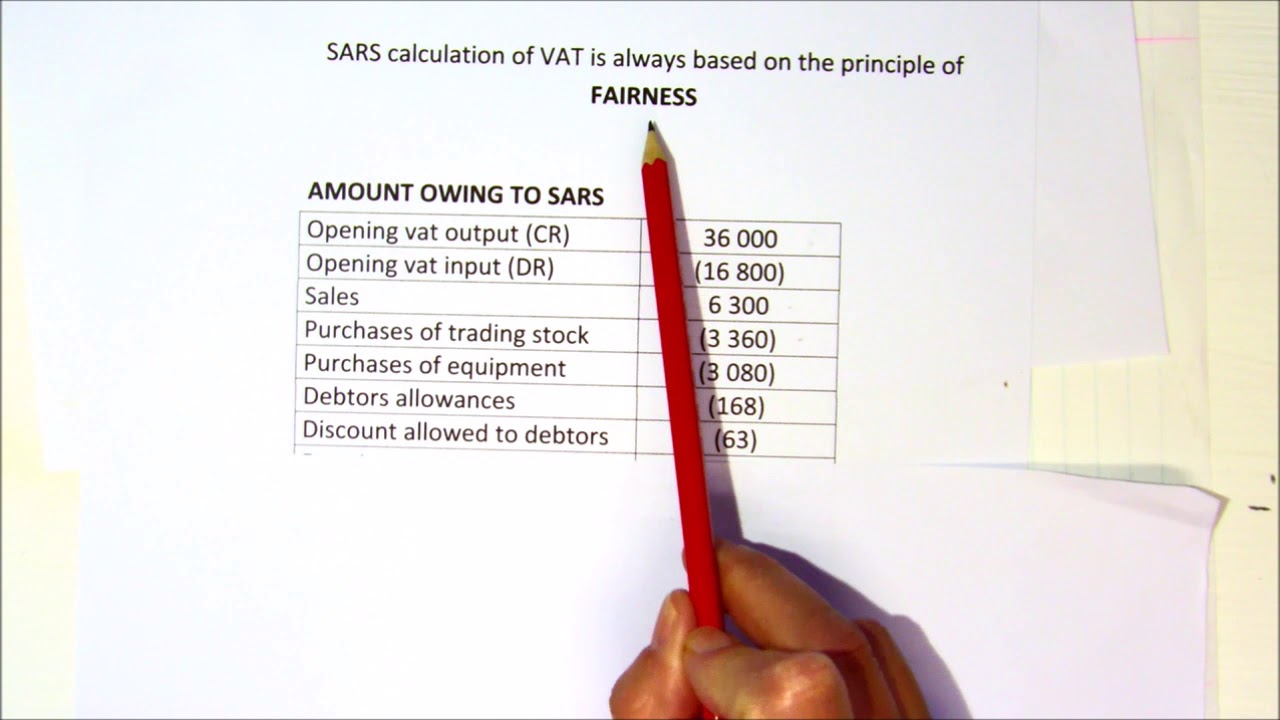

An input tax is a levy paid by a business on acquired goods and services An example of an input tax is the value added tax When a business then taxes its customers this is considered an output tax The business pays the federal revenue authority the difference between the output tax and input tax if the amount is positive

What is input tax Input tax is the VAT incurred on the purchase of goods and services that are liable for VAT If the purchaser is VAT registered and the costs are incurred in the course of making taxable supplies Input VAT incurred in the period if offset against output VAT charged during the same period with the difference due to HMRC

Printables for free cover a broad variety of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of styles, from worksheets to templates, coloring pages, and much more. The attraction of printables that are free is in their versatility and accessibility.

More of What Is Input And Output Tax

Goods And Services Tax GST In Singapore What Is It

Goods And Services Tax GST In Singapore What Is It

What many people do not know is that there are two types of VAT the input and the output The difference between them is in who is the seller and the customer or recipient of the product or service as well as how to calculate them In this article of AYCE Laborytax we are going to explain what is the input VAT and the output VAT

135K subscribers 1 5K 72K views 2 years ago Counttuts In this video we explain Input VAT Output VAT and the difference between Input VAT and Output VAT We also explain why Input

What Is Input And Output Tax have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization The Customization feature lets you tailor the templates to meet your individual needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Free educational printables offer a wide range of educational content for learners of all ages, which makes them a valuable resource for educators and parents.

-

An easy way to access HTML0: Access to a variety of designs and templates saves time and effort.

Where to Find more What Is Input And Output Tax

Difference Between Input And Output Devices What Is Input Device

Difference Between Input And Output Devices What Is Input Device

Input VAT is the VAT included in the price for VAT taxable goods or services you buy to use in your business Output VAT is the VAT you must charge when you sell goods or services provided your business is registered to do so Output VAT must be calculated and collected on both sales to other businesses and sales to ordinary

The input VAT is 10 333 In the same period the business sells goods for 150 000 excl VAT as they are not registered The output VAT is 30 000 In the final VAT settlement authority deducts output VAT from input VAT which results into 17 600 The final amount must be reported to your regional tax office

Since we've got your interest in What Is Input And Output Tax We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of What Is Input And Output Tax suitable for many objectives.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast range of interests, that includes DIY projects to planning a party.

Maximizing What Is Input And Output Tax

Here are some ways for you to get the best of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free for teaching at-home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

What Is Input And Output Tax are a treasure trove of innovative and useful resources that cater to various needs and preferences. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the many options of What Is Input And Output Tax and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes you can! You can download and print these documents for free.

-

Can I make use of free printables for commercial use?

- It depends on the specific terms of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with What Is Input And Output Tax?

- Certain printables might have limitations concerning their use. Be sure to read the terms and condition of use as provided by the designer.

-

How do I print What Is Input And Output Tax?

- You can print them at home with any printer or head to a local print shop to purchase top quality prints.

-

What software do I need to open printables at no cost?

- The majority of printed documents are as PDF files, which can be opened using free software like Adobe Reader.

Input VAT Vs Output VAT Explained YouTube

What Is Input Credit ITC Under GST

Check more sample of What Is Input And Output Tax below

What Is Input Tax And Output VAT

Output Tax CEOpedia Management Online

Input Output Devices

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

Input Tax Vs Output Tax Joan Miller

INPUT OUTPUT Tax Adjustment Manual Method QNE Software Sdn Bhd

https://www. thevatpeople.co.uk /services/general...

What is input tax Input tax is the VAT incurred on the purchase of goods and services that are liable for VAT If the purchaser is VAT registered and the costs are incurred in the course of making taxable supplies Input VAT incurred in the period if offset against output VAT charged during the same period with the difference due to HMRC

https:// marosavat.com /what-is-input-vat-and-output-vat

When talking about what input VAT is it is defined as the VAT applied to company purchases of goods or services by your business Essentially this is VAT that was already paid by your business on those transactions and can be later deducted on your VAT return

What is input tax Input tax is the VAT incurred on the purchase of goods and services that are liable for VAT If the purchaser is VAT registered and the costs are incurred in the course of making taxable supplies Input VAT incurred in the period if offset against output VAT charged during the same period with the difference due to HMRC

When talking about what input VAT is it is defined as the VAT applied to company purchases of goods or services by your business Essentially this is VAT that was already paid by your business on those transactions and can be later deducted on your VAT return

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

Output Tax CEOpedia Management Online

Input Tax Vs Output Tax Joan Miller

INPUT OUTPUT Tax Adjustment Manual Method QNE Software Sdn Bhd

Input Tax Vs Output Tax Nigelctzx

What Is An Output Device My Computer Notes

What Is An Output Device My Computer Notes

Let s Talk Input And Output