In this digital age, when screens dominate our lives and the appeal of physical printed materials isn't diminishing. Be it for educational use in creative or artistic projects, or just adding an element of personalization to your area, What Is Input And Output Tax Credit are a great resource. This article will dive in the world of "What Is Input And Output Tax Credit," exploring their purpose, where to find them and how they can improve various aspects of your lives.

Get Latest What Is Input And Output Tax Credit Below

What Is Input And Output Tax Credit

What Is Input And Output Tax Credit -

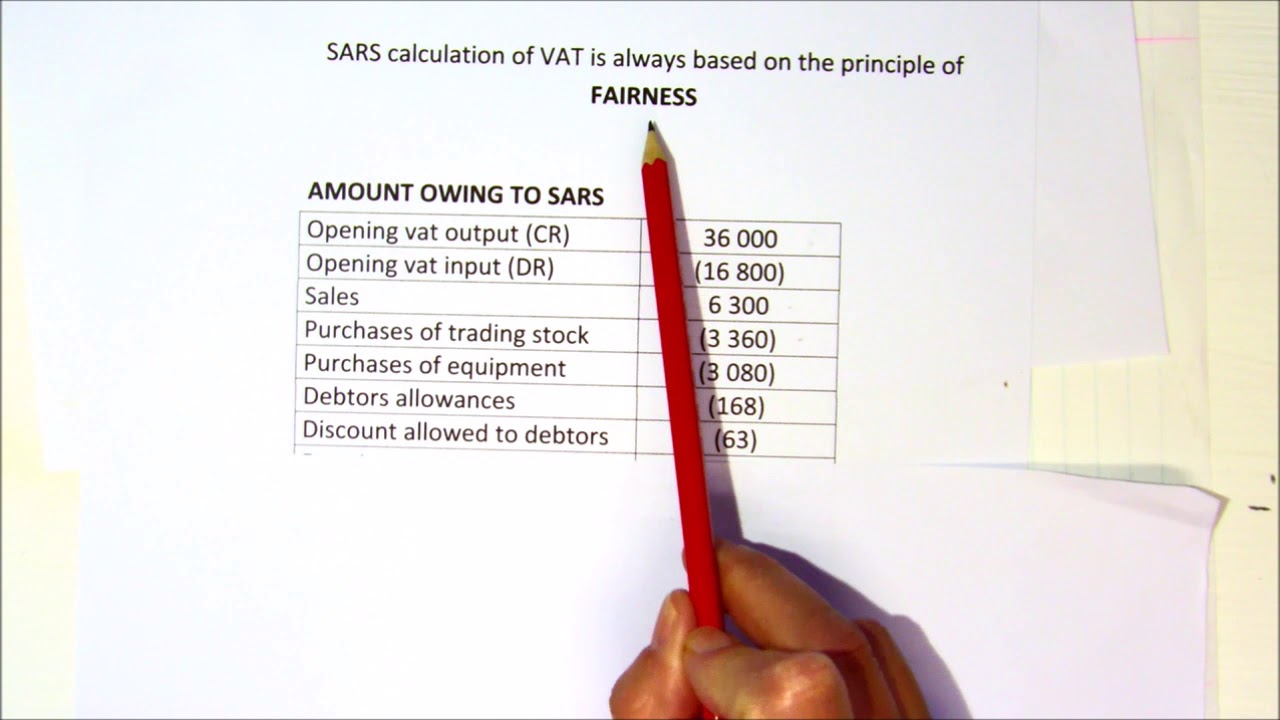

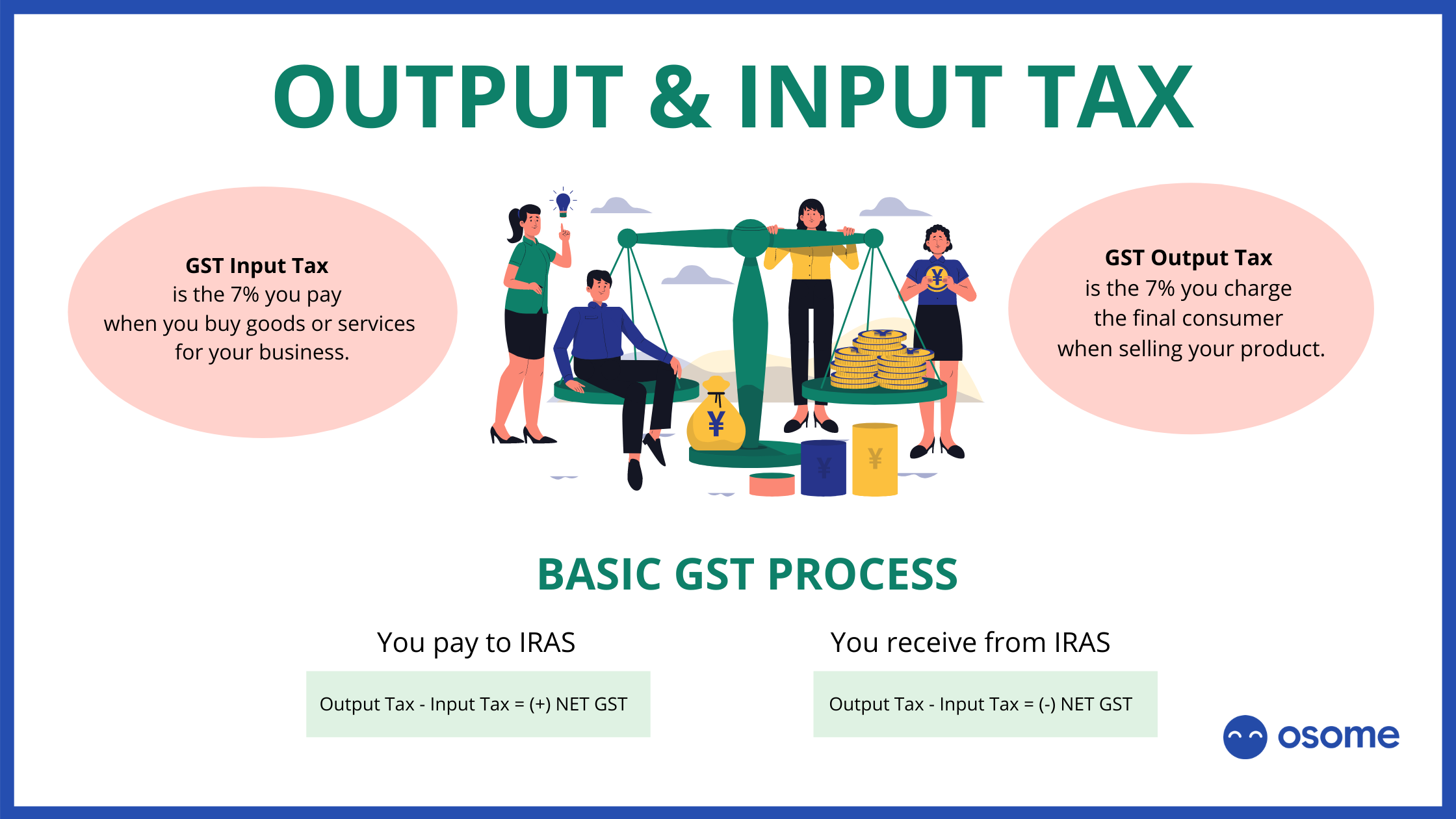

Input tax credit or ITC enables businesses to reduce the tax liability as it makes a sale by claiming the credit depending on how much GST was paid on the business s

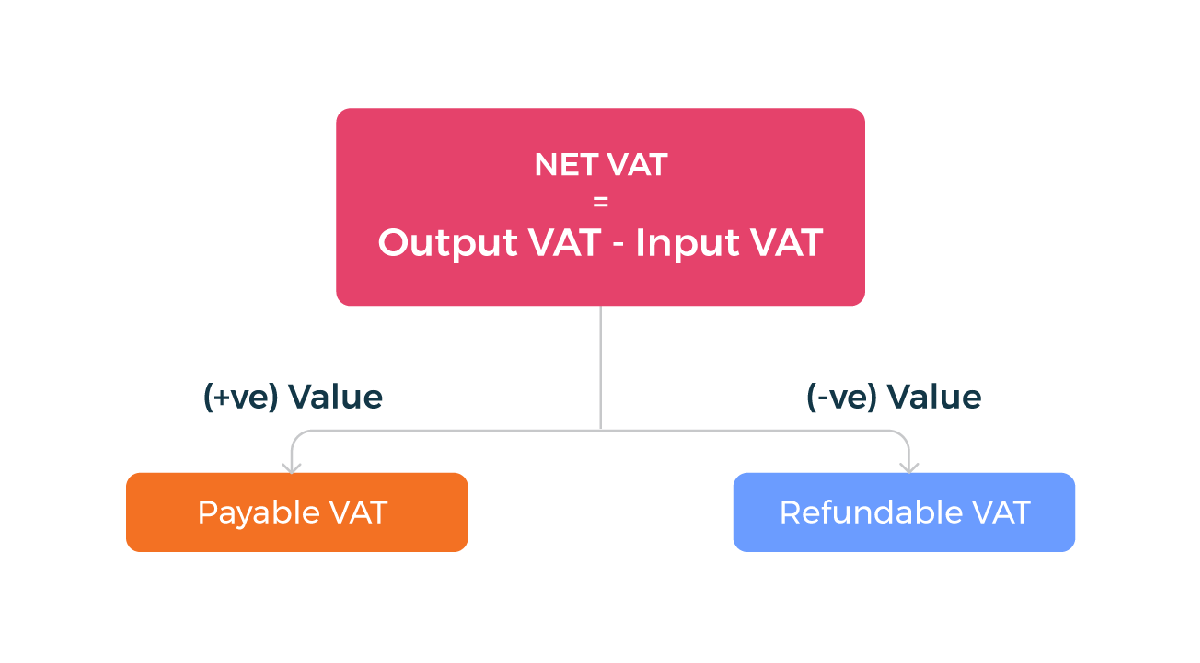

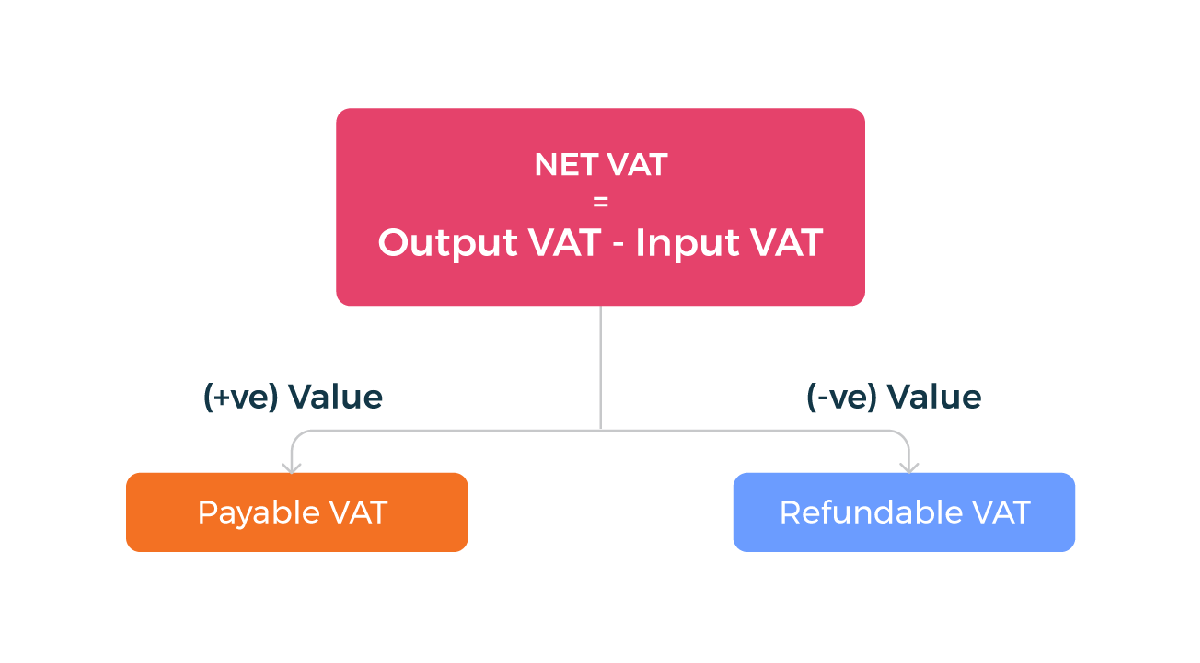

Input VAT is the value added tax added to the price of goods and services a business buys while output VAT is the value added tax that is charged on the sales of goods

What Is Input And Output Tax Credit cover a large range of downloadable, printable material that is available online at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and more. The beauty of What Is Input And Output Tax Credit is their flexibility and accessibility.

More of What Is Input And Output Tax Credit

What Is Input Credit ITC Under GST

What Is Input Credit ITC Under GST

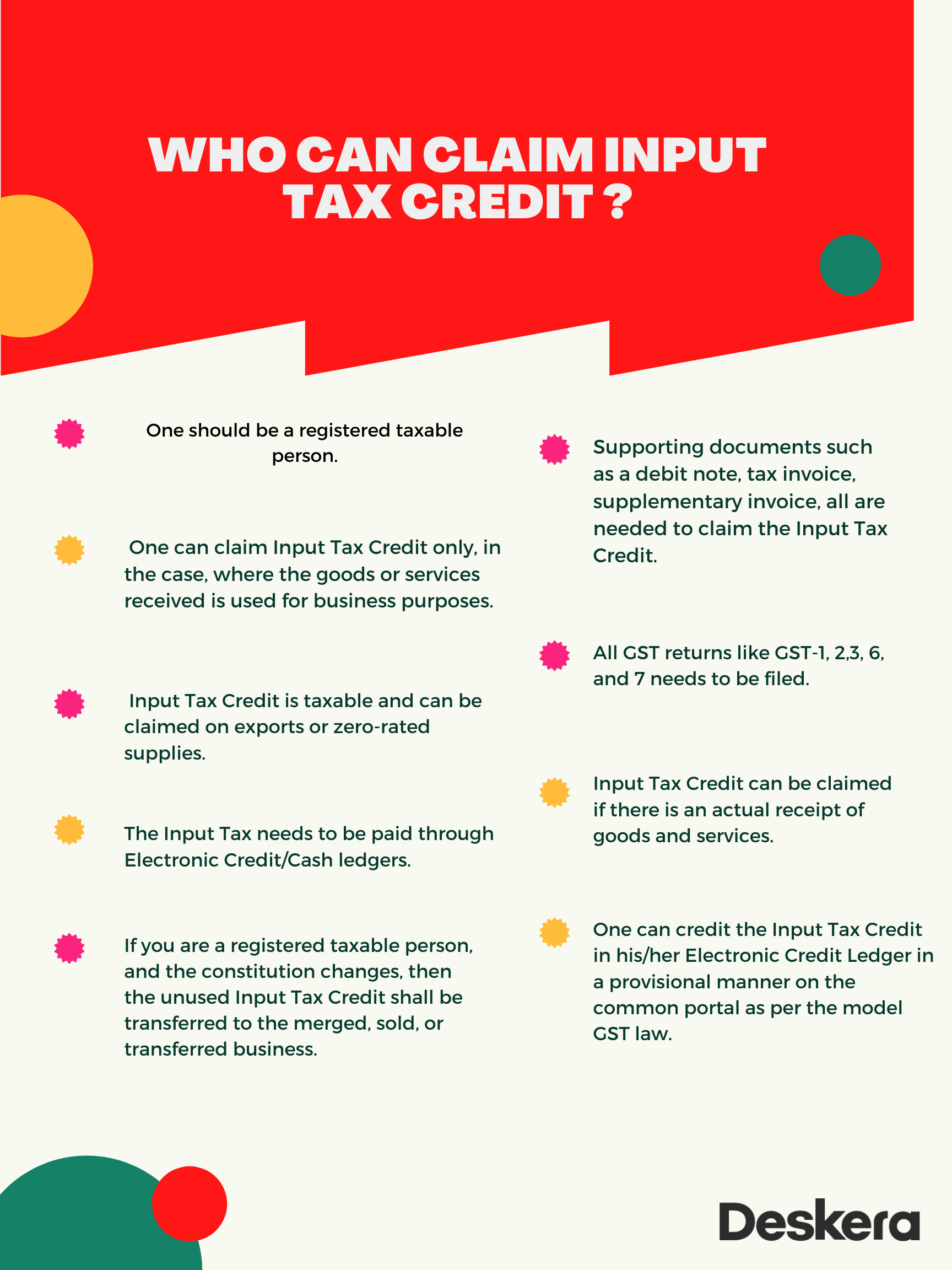

What is input tax credit Input tax credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount Here s how When you buy a product service

Unlock the secrets of Input Tax Credit ITC under GST regime Learn eligibility types claiming process common mistakes and FAQs for seamless compliance

What Is Input And Output Tax Credit have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization The Customization feature lets you tailor the templates to meet your individual needs, whether it's designing invitations and schedules, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages, which makes them a vital tool for parents and teachers.

-

The convenience of You have instant access an array of designs and templates reduces time and effort.

Where to Find more What Is Input And Output Tax Credit

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

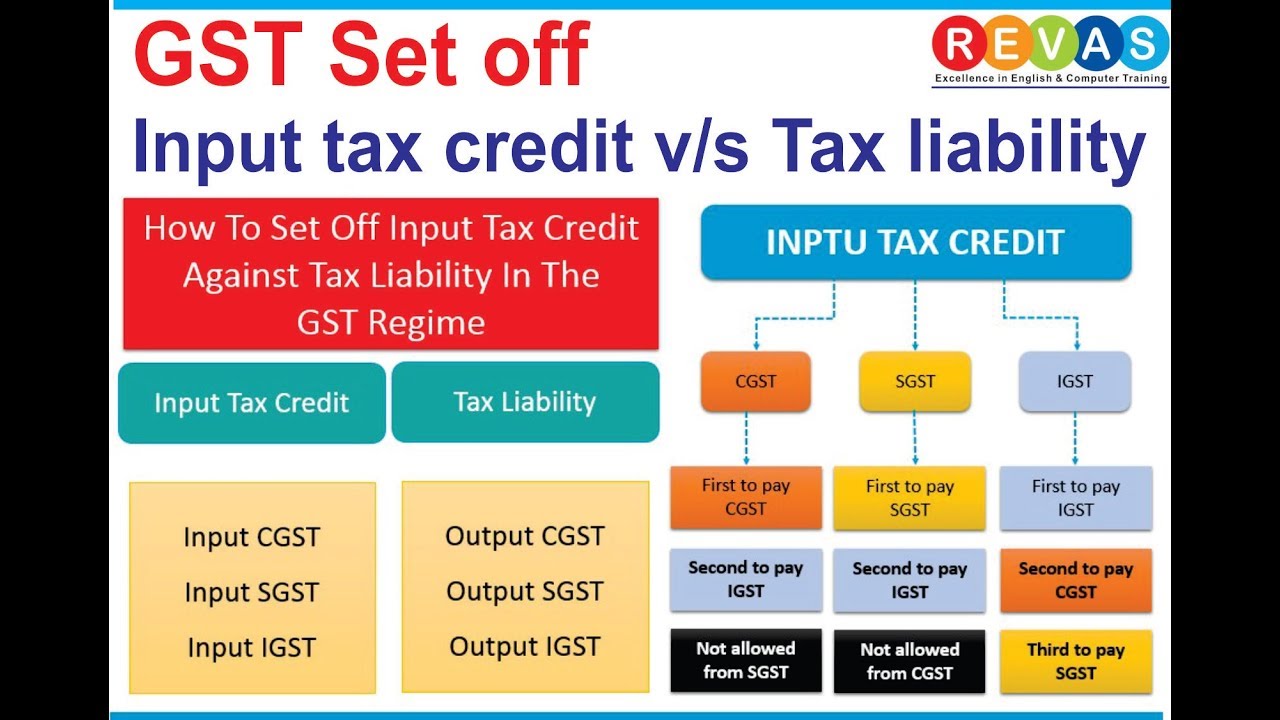

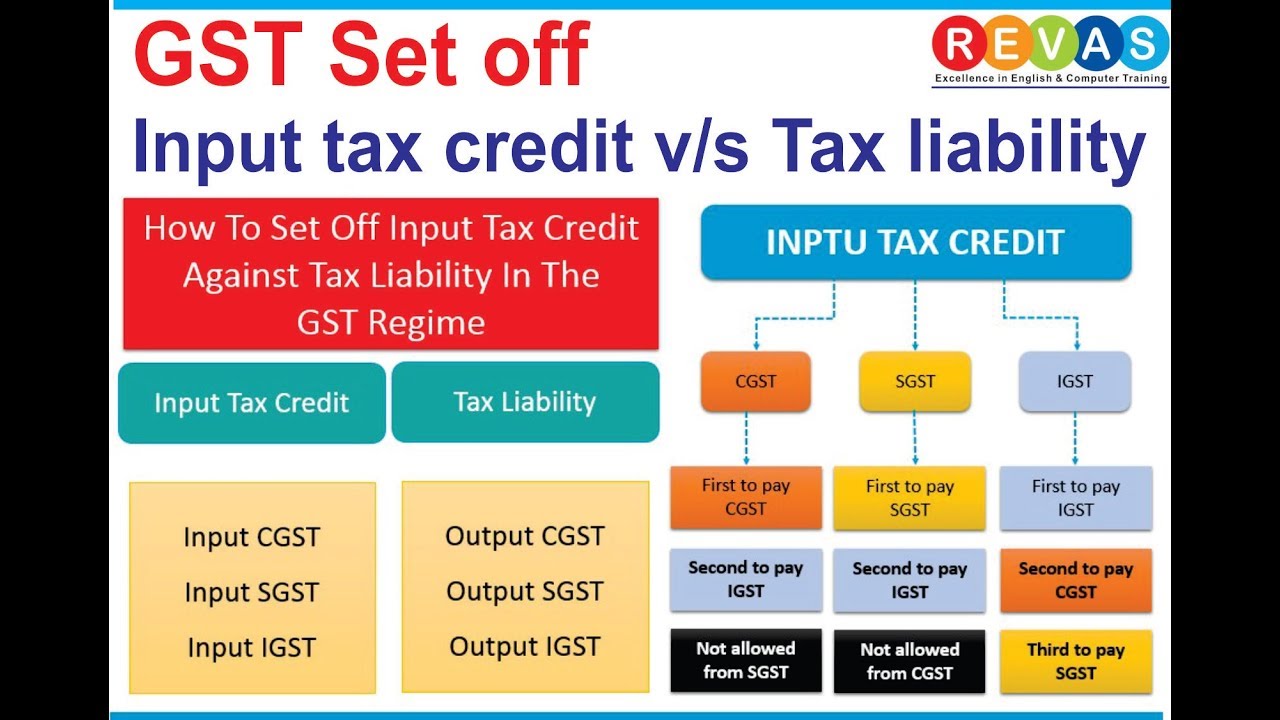

Output tax credit or output tax set off is a system in which businesses can set off the GST collected output tax against the GST paid input tax In other words it allows

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is

Since we've got your interest in What Is Input And Output Tax Credit We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of What Is Input And Output Tax Credit designed for a variety reasons.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing What Is Input And Output Tax Credit

Here are some unique ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is Input And Output Tax Credit are a treasure trove filled with creative and practical information which cater to a wide range of needs and interest. Their availability and versatility make them an essential part of both professional and personal lives. Explore the wide world of What Is Input And Output Tax Credit today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print the resources for free.

-

Can I use the free printables to make commercial products?

- It is contingent on the specific usage guidelines. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables could have limitations on use. Be sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit an in-store print shop to get the highest quality prints.

-

What software is required to open printables free of charge?

- Many printables are offered in PDF format. These can be opened with free software like Adobe Reader.

Input Tax Vs Output Tax Nigelctzx

Learn Accounting Entries Under GST With Journal Entry RCM Meteorio

Check more sample of What Is Input And Output Tax Credit below

Goods And Services Tax GST In Singapore What Is It

Input Tax Credit Guide Under GST Calculation With Examples

What Is Input Tax Credit ITC INSIGHTSIAS

Input Tax Credit Calculation Difference Case Entry GST Practical

Gst Set Off Rules

Tax University Articles Canara HSBC Life Insurance

https://www.taxually.com/blog/input-vat-and-output...

Input VAT is the value added tax added to the price of goods and services a business buys while output VAT is the value added tax that is charged on the sales of goods

https://cleartax.in/s/gst-output-tax-credit

Input Tax Credit ITC is the tax credit businesses earn for the tax paid on inputs and services used in production or service provision Let s consider an example

Input VAT is the value added tax added to the price of goods and services a business buys while output VAT is the value added tax that is charged on the sales of goods

Input Tax Credit ITC is the tax credit businesses earn for the tax paid on inputs and services used in production or service provision Let s consider an example

Input Tax Credit Calculation Difference Case Entry GST Practical

Input Tax Credit Guide Under GST Calculation With Examples

Gst Set Off Rules

Tax University Articles Canara HSBC Life Insurance

What Is Input Tax Credit Under Gst Upsc

Input Credit Deductions And Refunds Zoho Books KSA

Input Credit Deductions And Refunds Zoho Books KSA

Input Credit Under GST Credits