In the age of digital, with screens dominating our lives The appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or simply adding an individual touch to your space, What Is Input And Output Vat are now a vital resource. Through this post, we'll dive into the world "What Is Input And Output Vat," exploring what they are, where they can be found, and ways they can help you improve many aspects of your daily life.

Get Latest What Is Input And Output Vat Below

What Is Input And Output Vat

What Is Input And Output Vat -

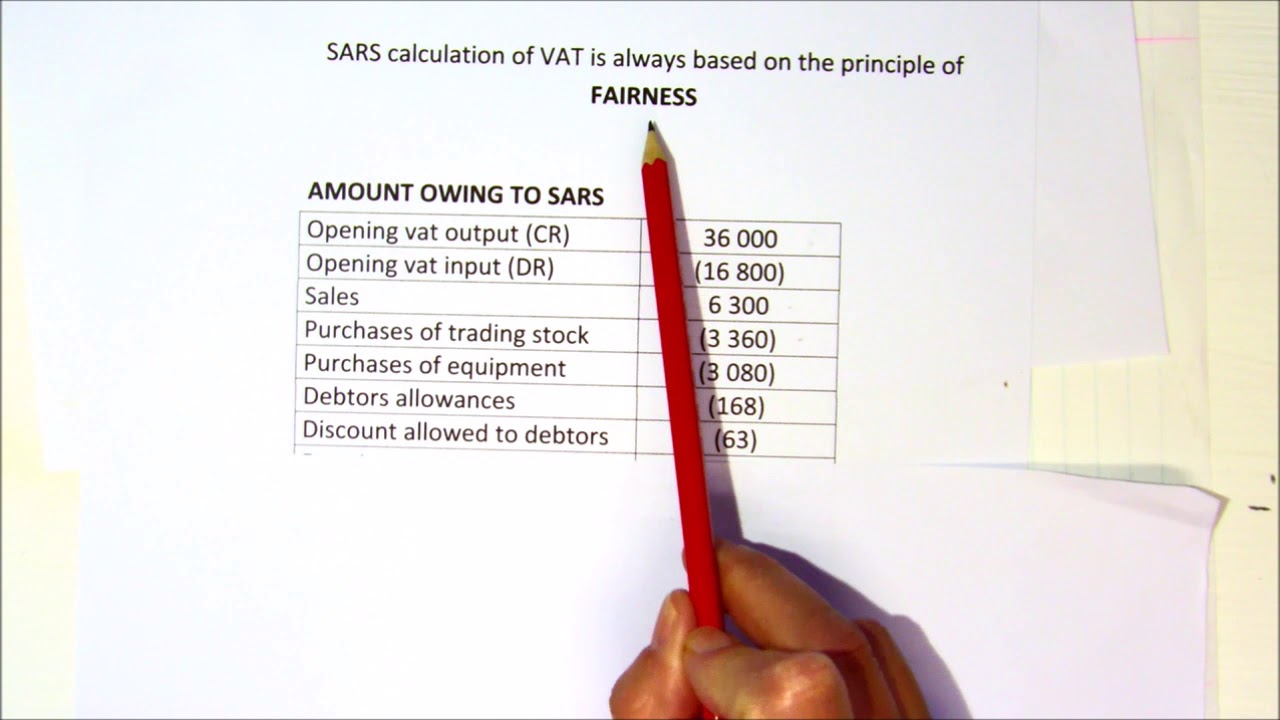

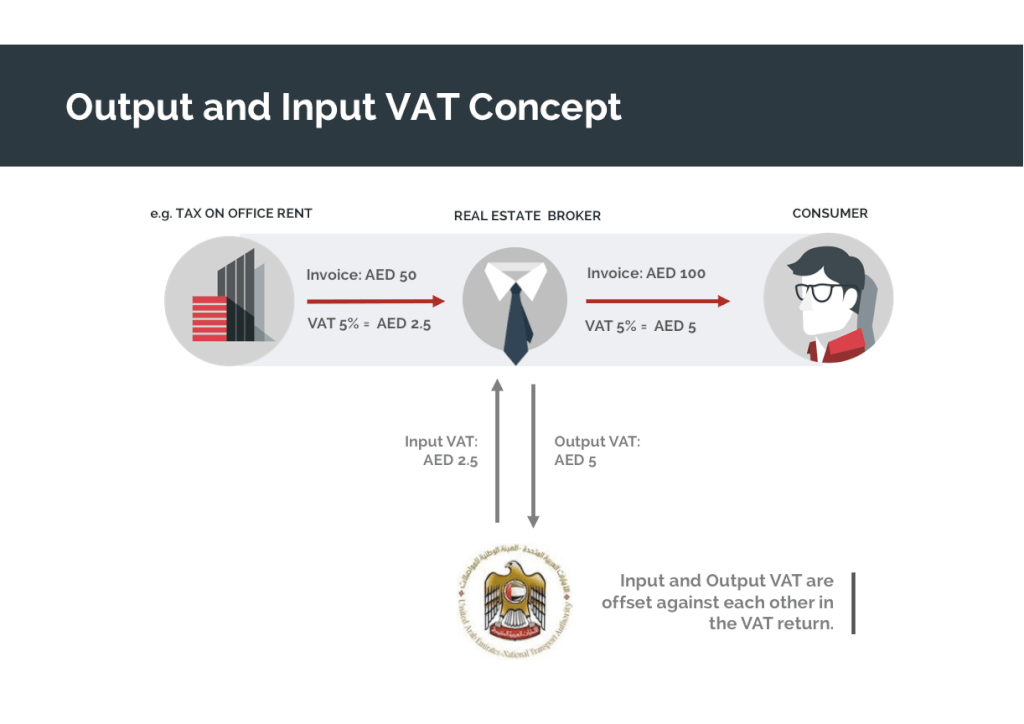

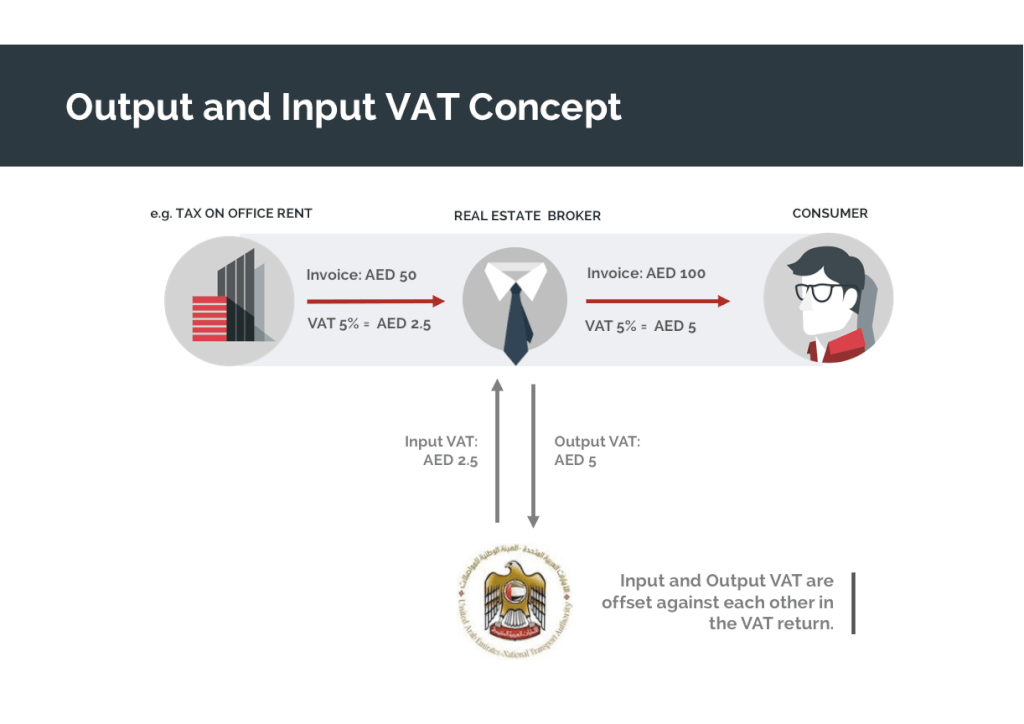

The output VAT 7 5 VAT you charge on goods and services you supply or sell while the Input VAT The 7 5 VAT you pay on items and services used by

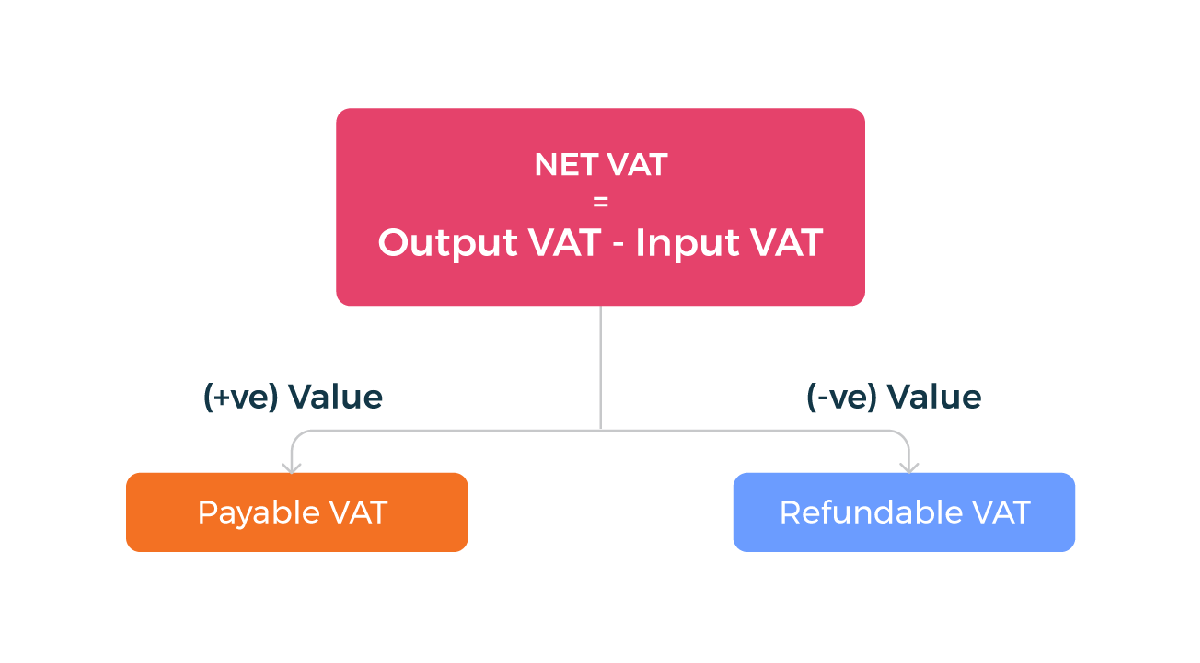

1 Input VAT is less than your Output VAT In this situation the VAT due on the net amount of sales of goods or services is greater than the VAT to be deducted on

What Is Input And Output Vat provide a diverse assortment of printable, downloadable material that is available online at no cost. They come in many types, like worksheets, templates, coloring pages and much more. The appeal of printables for free lies in their versatility and accessibility.

More of What Is Input And Output Vat

Input And Output Vat YouTube

Input And Output Vat YouTube

The difference between your input and output VAT is either the amount you owe to HMRC or the amount you can reclaim On your VAT return you will report the total input VAT

Recording input and output VAT in financial statements requires accuracy and systematic accounting practices Each transaction must be documented with VAT

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring printables to fit your particular needs be it designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: The free educational worksheets cater to learners of all ages, which makes them an invaluable device for teachers and parents.

-

It's easy: instant access the vast array of design and templates helps save time and effort.

Where to Find more What Is Input And Output Vat

Determining The VAT Portion And VAT Input And Output YouTube

Determining The VAT Portion And VAT Input And Output YouTube

Input VAT is the VAT included in the price for VAT taxable goods or services you buy to use in your business Output VAT is the VAT you must charge when you sell

It is presented through form 303 where the VAT of all the operations carried out during the last three months must be recorded and justified differentiating between

After we've peaked your curiosity about What Is Input And Output Vat we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of What Is Input And Output Vat suitable for many uses.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning materials.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a wide range of topics, that range from DIY projects to party planning.

Maximizing What Is Input And Output Vat

Here are some ideas that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is Input And Output Vat are an abundance of useful and creative resources for a variety of needs and pursuits. Their accessibility and flexibility make them a great addition to every aspect of your life, both professional and personal. Explore the wide world of What Is Input And Output Vat and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can print and download these resources at no cost.

-

Can I utilize free printables in commercial projects?

- It's based on specific rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations in use. You should read the terms and conditions provided by the creator.

-

How can I print What Is Input And Output Vat?

- Print them at home with an printer, or go to an in-store print shop to get top quality prints.

-

What software do I require to open printables at no cost?

- Many printables are offered as PDF files, which can be opened with free software such as Adobe Reader.

Input Credit Deductions And Refunds Zoho Books KSA

Introduction To VAT

Check more sample of What Is Input And Output Vat below

Know What Is Value Added Tax VAT And How Does It Work Succinct FP

VAT What You Need To Know Now

The Comprehensive Guide To VAT In Europe For Ecommerce Sellers

Input VAT Vs Output VAT Explained YouTube

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

What Is Output And Input VAT Mirandus Accountants

https://marosavat.com/what-is-input-vat-and-output-vat

1 Input VAT is less than your Output VAT In this situation the VAT due on the net amount of sales of goods or services is greater than the VAT to be deducted on

https://calculatethevat.com/output-and-input-vat

The primary difference between output and input VAT is that the recipient is the business while the customer pays the tax in the other Both types hold sheer

1 Input VAT is less than your Output VAT In this situation the VAT due on the net amount of sales of goods or services is greater than the VAT to be deducted on

The primary difference between output and input VAT is that the recipient is the business while the customer pays the tax in the other Both types hold sheer

Input VAT Vs Output VAT Explained YouTube

VAT What You Need To Know Now

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

What Is Output And Input VAT Mirandus Accountants

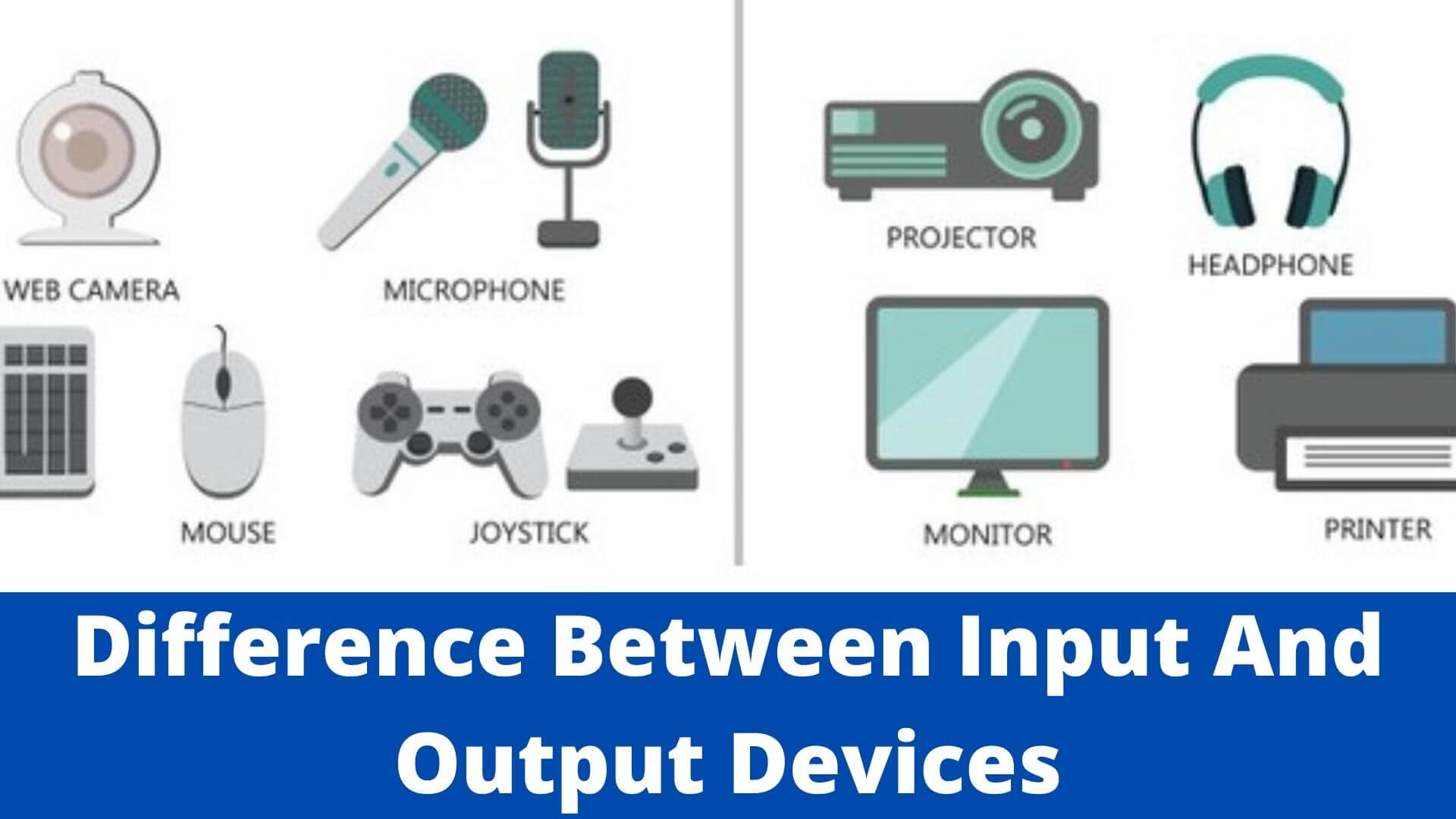

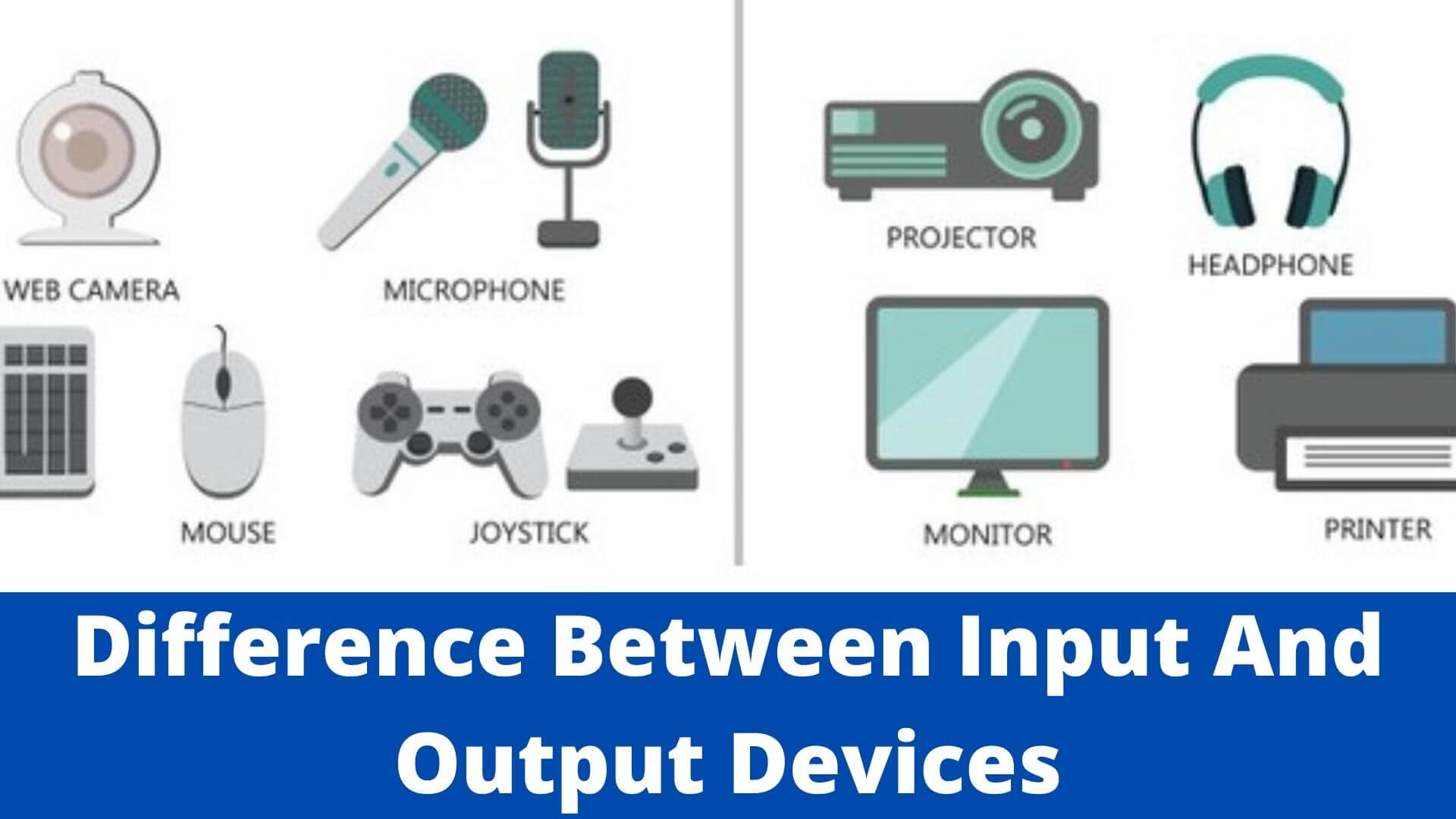

Input Device And Output Devices StudyMuch

Difference Between Input And Output Devices Expose Times

Difference Between Input And Output Devices Expose Times

Input And Output Devices Of A Computer NollyTech