In the digital age, where screens dominate our lives and the appeal of physical, printed materials hasn't diminished. Whatever the reason, whether for education, creative projects, or simply to add personal touches to your home, printables for free are now a useful resource. In this article, we'll dive deeper into "What Is Input Tax And Output Tax In The Philippines," exploring the different types of printables, where to locate them, and how they can enhance various aspects of your lives.

Get Latest What Is Input Tax And Output Tax In The Philippines Below

What Is Input Tax And Output Tax In The Philippines

What Is Input Tax And Output Tax In The Philippines -

This video explains what Input Tax is and the kinds of input taxes in the Philippines namely Actual input tax transitional presumptive and standard sale

A VAT refund in the Philippines is a difficult process and the proper substantiation of sales output tax and purchases input tax is critical including

The What Is Input Tax And Output Tax In The Philippines are a huge collection of printable documents that can be downloaded online at no cost. These resources come in various forms, like worksheets templates, coloring pages, and more. The great thing about What Is Input Tax And Output Tax In The Philippines lies in their versatility as well as accessibility.

More of What Is Input Tax And Output Tax In The Philippines

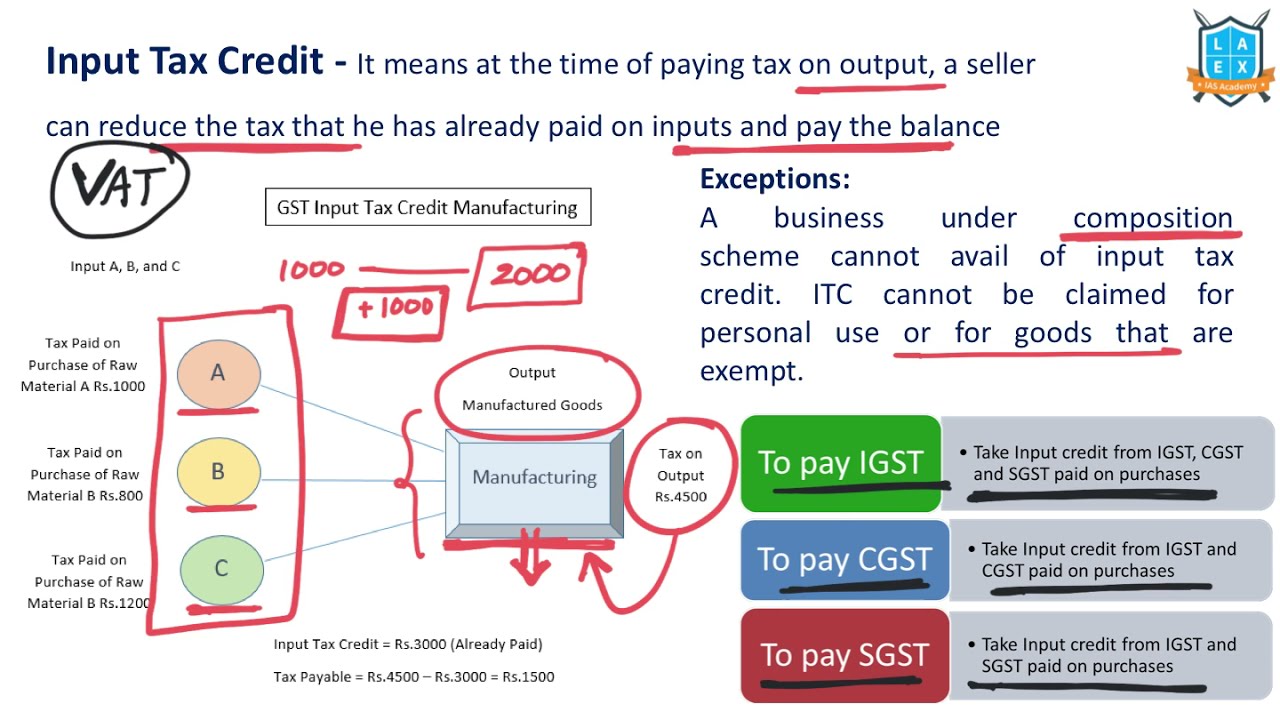

What Is Input Tax Credit Input Tax Credit La

What Is Input Tax Credit Input Tax Credit La

Under Section 114 of the Tax Code as amended input VAT from zero rated sales of goods and services in the Philippines are allowed the following options Creditable input VAT

Types of Taxes in the Philippines To understand taxation it s essential to know the different types of taxes imposed by the government Direct taxes This type of

What Is Input Tax And Output Tax In The Philippines have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: They can make the templates to meet your individual needs be it designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages, making the perfect tool for parents and teachers.

-

Affordability: The instant accessibility to many designs and templates reduces time and effort.

Where to Find more What Is Input Tax And Output Tax In The Philippines

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

Under the final withholding tax system the 5 final VAT withheld is already considered full and final payment due from the seller This means that the seller in

VAT tax rates in the Philippines Monthly returns consider the output VAT for the month and input VAT for the month along with carry over input VAT from the previous period Quarterly value added tax returns utilize

We hope we've stimulated your curiosity about What Is Input Tax And Output Tax In The Philippines Let's look into where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in What Is Input Tax And Output Tax In The Philippines for different purposes.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs are a vast variety of topics, ranging from DIY projects to planning a party.

Maximizing What Is Input Tax And Output Tax In The Philippines

Here are some unique ways of making the most use of What Is Input Tax And Output Tax In The Philippines:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

What Is Input Tax And Output Tax In The Philippines are a treasure trove of creative and practical resources that cater to various needs and preferences. Their access and versatility makes them an essential part of any professional or personal life. Explore the wide world of What Is Input Tax And Output Tax In The Philippines today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can download and print these files for free.

-

Can I utilize free printables for commercial use?

- It's based on the usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations regarding usage. Make sure you read the terms of service and conditions provided by the author.

-

How can I print What Is Input Tax And Output Tax In The Philippines?

- You can print them at home with either a printer at home or in an in-store print shop to get top quality prints.

-

What software do I need to run What Is Input Tax And Output Tax In The Philippines?

- Most printables come in PDF format. These can be opened with free software such as Adobe Reader.

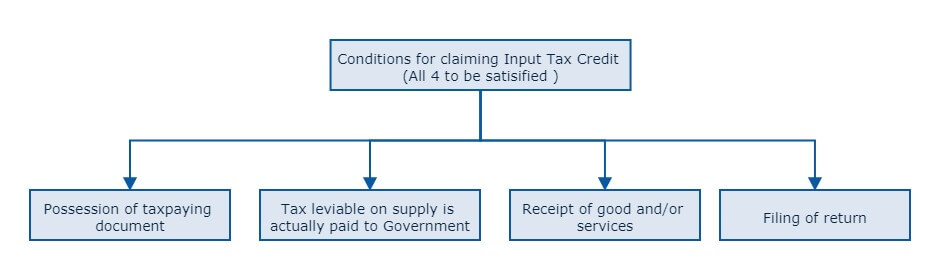

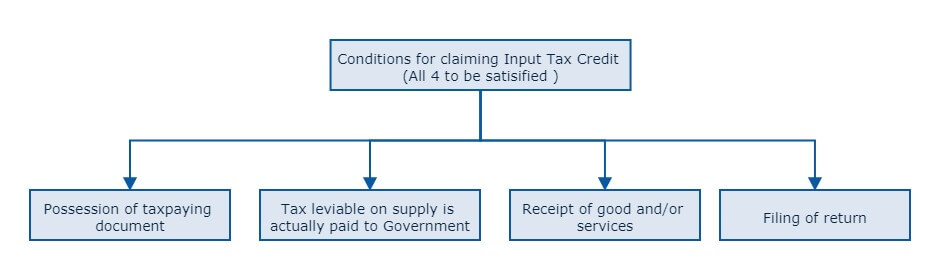

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

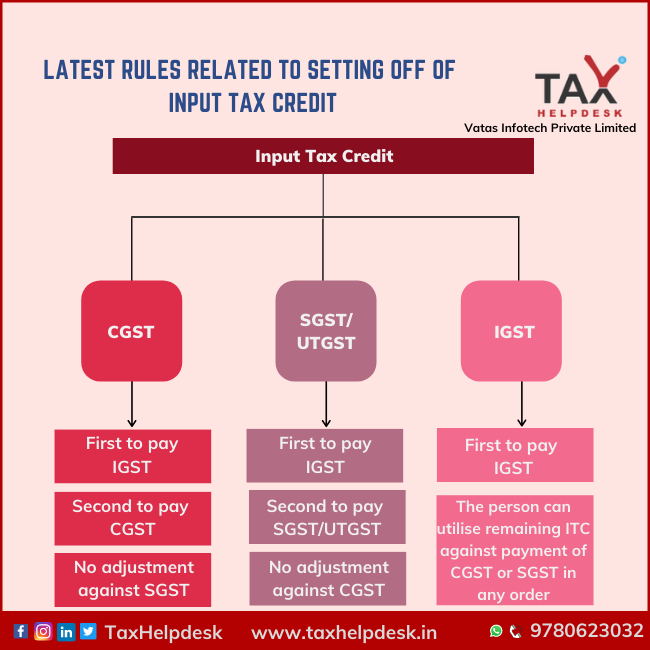

Rules Related To Setting Off Of Input Tax Credit

Check more sample of What Is Input Tax And Output Tax In The Philippines below

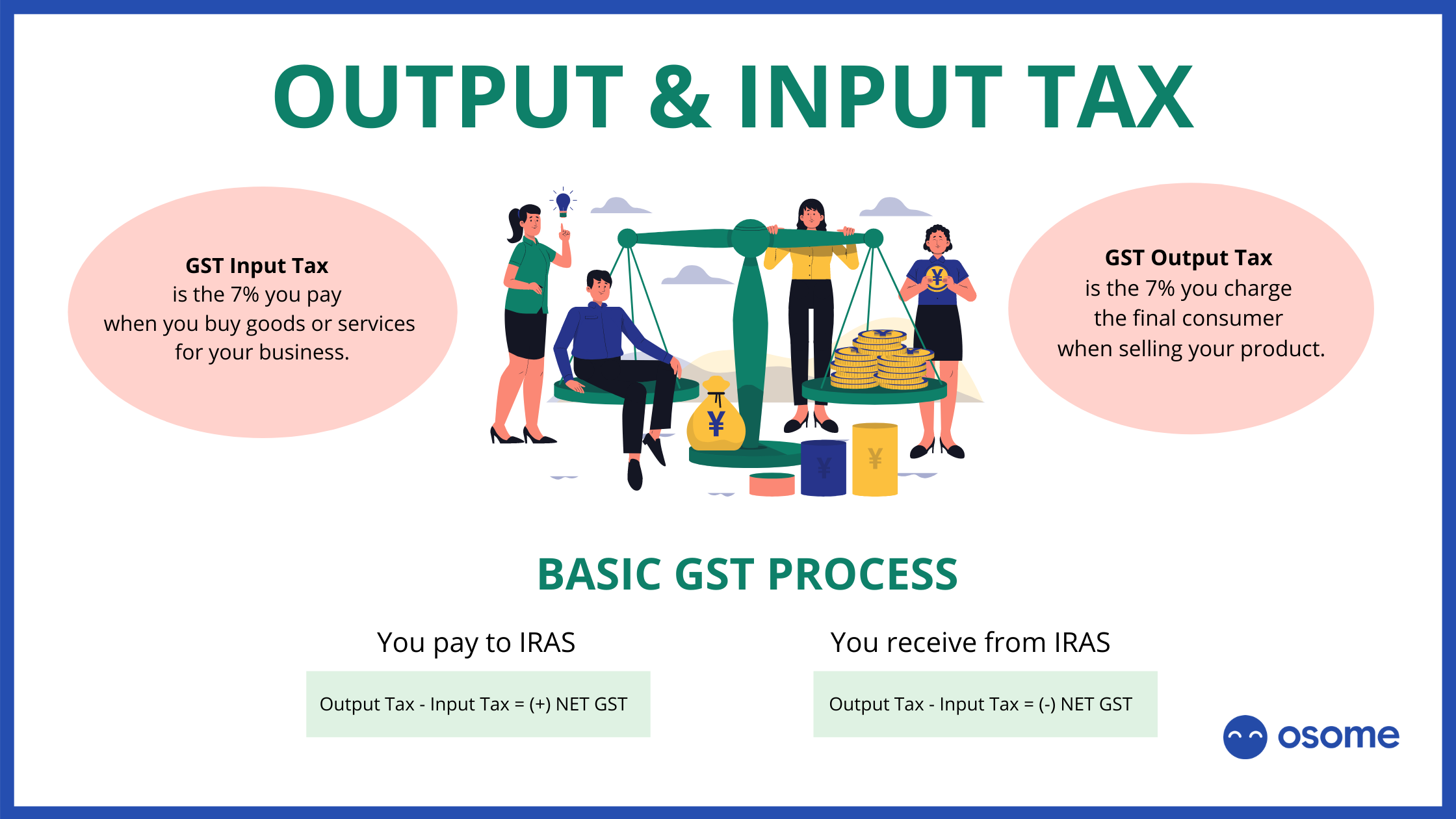

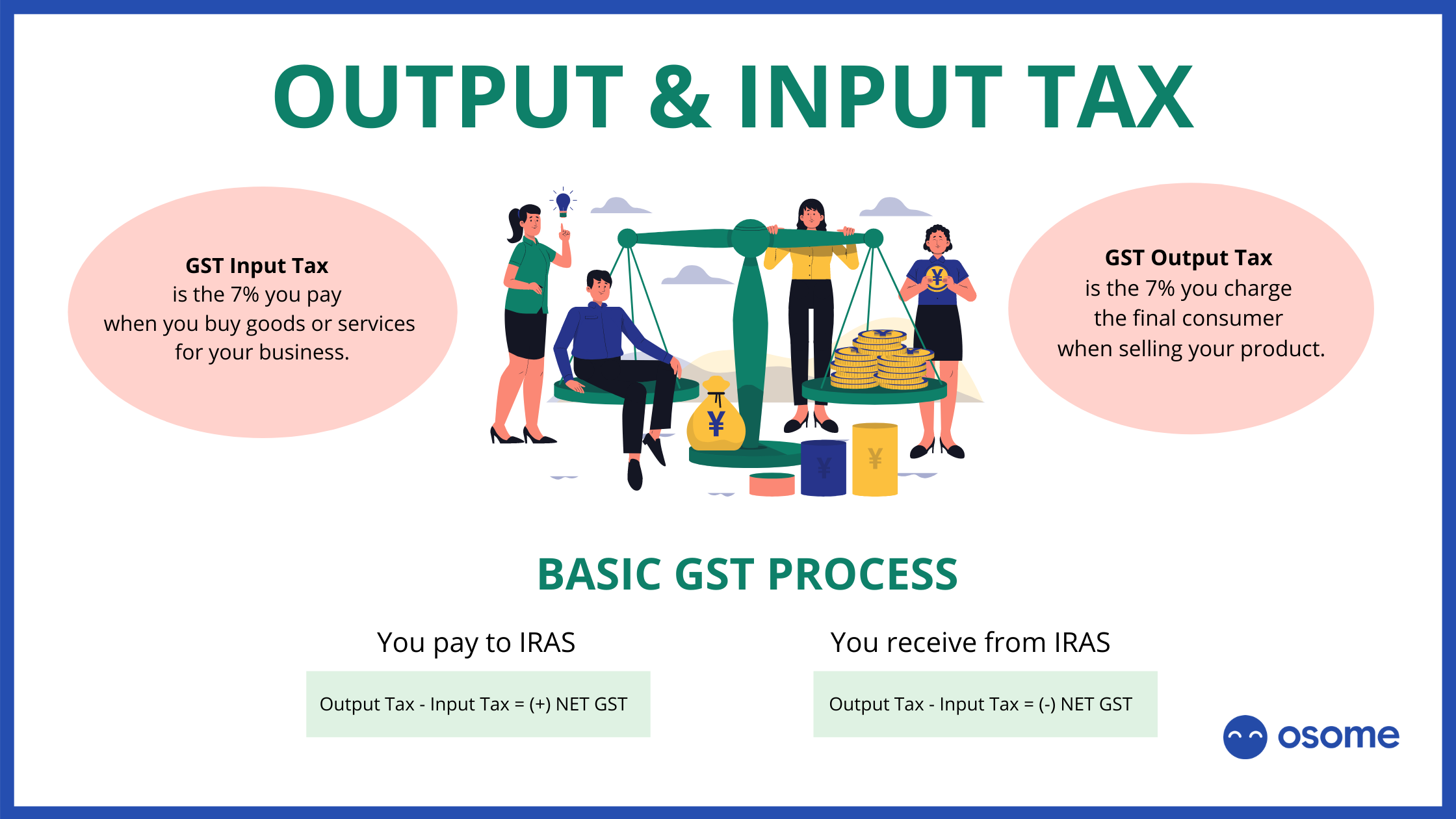

What Is Input Tax And Output VAT

What Is Input Credit ITC Under GST

What Is Input Tax Credit And How To Claim It YouTube

Goods And Services Tax GST In Singapore What Is It

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

What Is Input Tax And What Is It s Recovery Process Inspire MS Tax

https://kpmg.com/xx/en/home/insights/2019/10/...

A VAT refund in the Philippines is a difficult process and the proper substantiation of sales output tax and purchases input tax is critical including

https://www.bir.gov.ph/index.php/tax-information/value-added-tax.html

Value Added Tax is a form of sales tax It is a tax on consumption levied on the sale barter exchange or lease of goods or properties and services in the

A VAT refund in the Philippines is a difficult process and the proper substantiation of sales output tax and purchases input tax is critical including

Value Added Tax is a form of sales tax It is a tax on consumption levied on the sale barter exchange or lease of goods or properties and services in the

Goods And Services Tax GST In Singapore What Is It

What Is Input Credit ITC Under GST

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

What Is Input Tax And What Is It s Recovery Process Inspire MS Tax

What Is Input Tax Credit ITC INSIGHTSIAS

An In depth Look At Input Tax Credit Under GST Razorpay Business

An In depth Look At Input Tax Credit Under GST Razorpay Business

Input Tax Credit Reversal On Sale Of Shares Mutual Funds Chandan