In a world where screens rule our lives however, the attraction of tangible printed materials hasn't faded away. Whatever the reason, whether for education and creative work, or just adding an extra personal touch to your area, What Is Input And Output Vat Uk can be an excellent source. Here, we'll dive to the depths of "What Is Input And Output Vat Uk," exploring their purpose, where they can be found, and how they can enhance various aspects of your lives.

Get Latest What Is Input And Output Vat Uk Below

What Is Input And Output Vat Uk

What Is Input And Output Vat Uk -

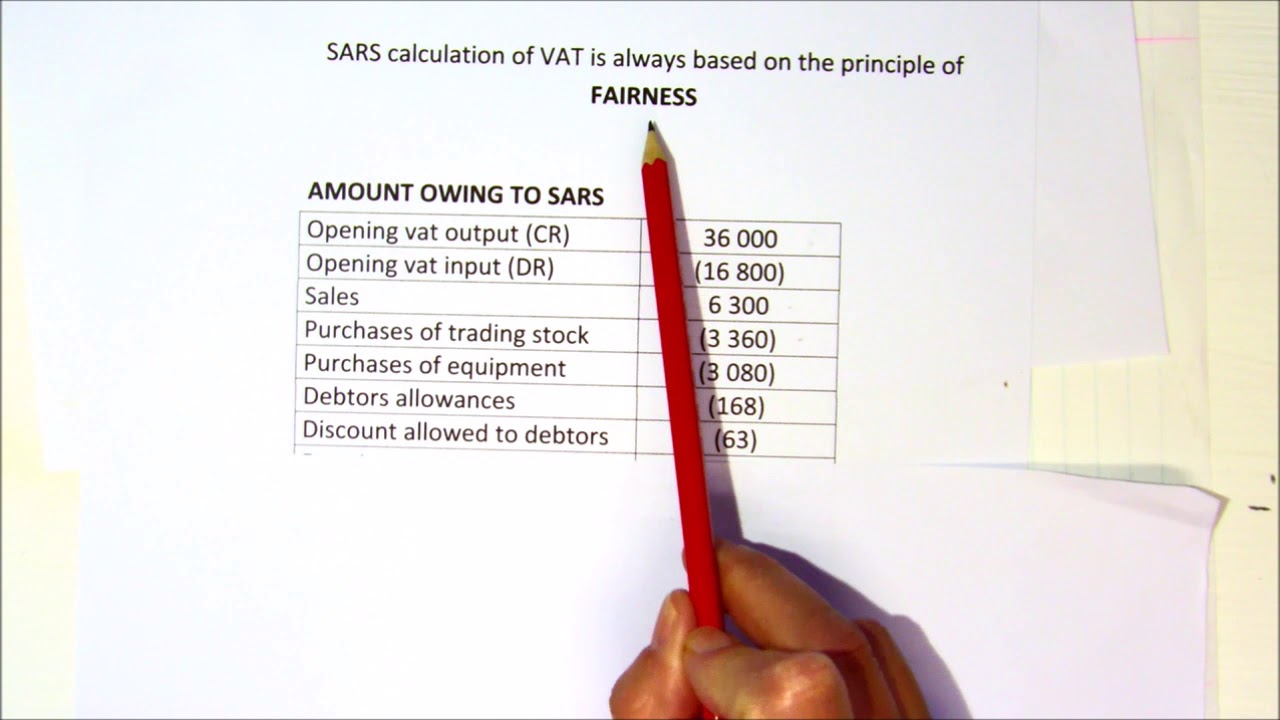

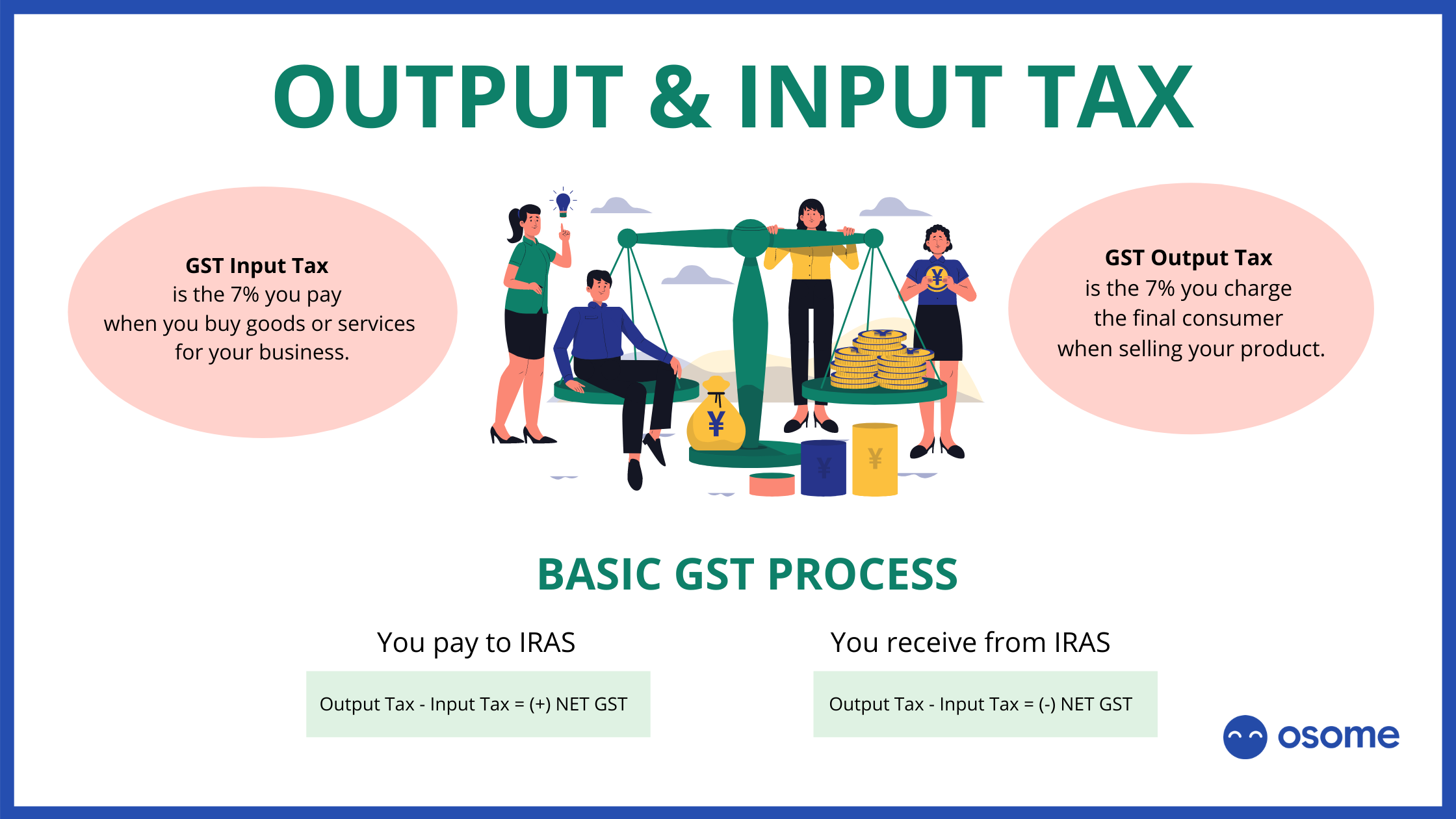

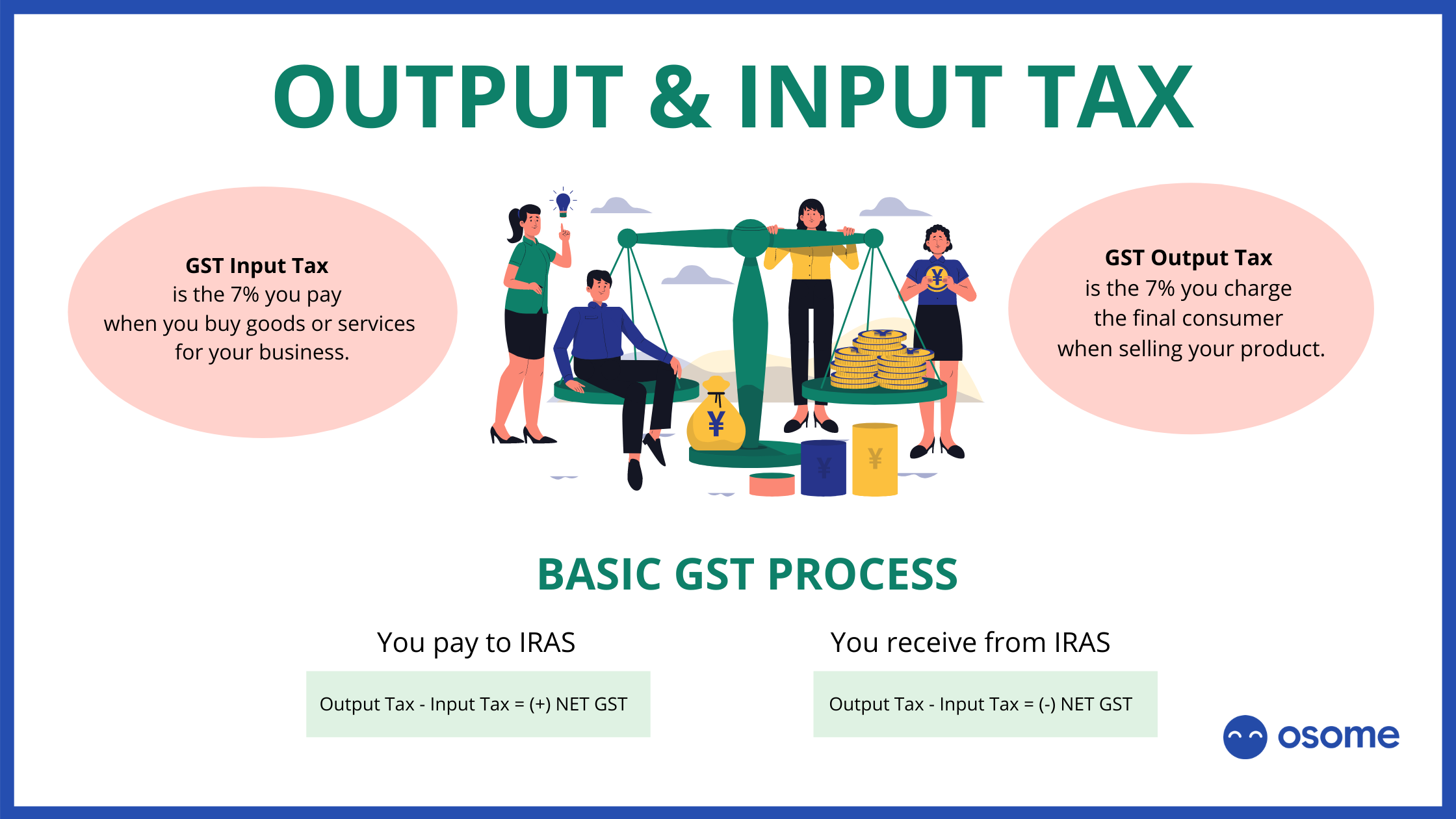

VAT exists in two types i e Output and Input VAT The primary difference between output and input VAT is that the recipient is the business while the customer pays the tax in the other Both types hold sheer

Input VAT is the VAT included in the price for VAT taxable goods or services you buy to use in your business Output VAT is the VAT you must charge when you sell goods

Printables for free cover a broad range of downloadable, printable materials that are accessible online for free cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The beauty of What Is Input And Output Vat Uk is in their versatility and accessibility.

More of What Is Input And Output Vat Uk

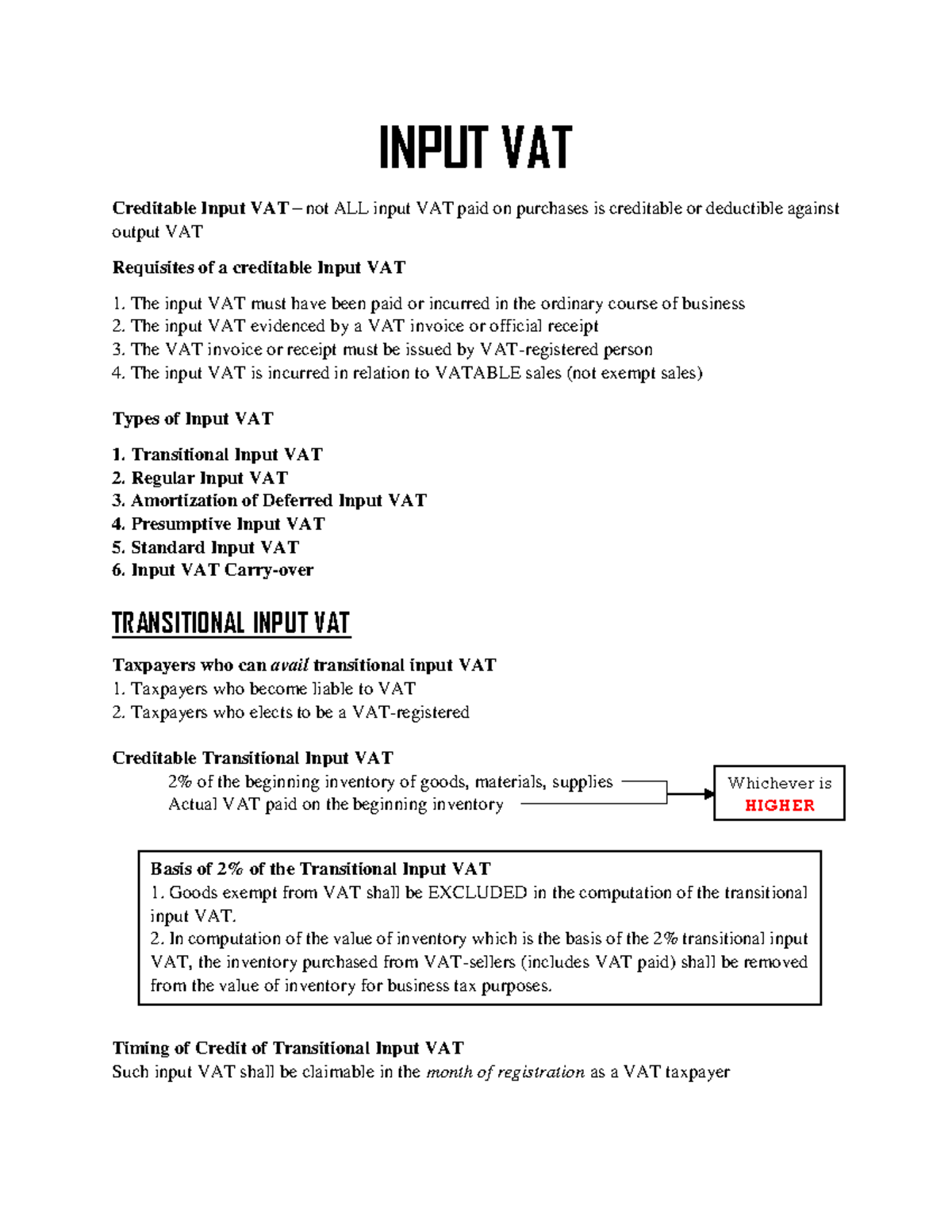

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

Input VAT is usually entered in box 4 of your VAT return under the heading VAT reclaimed in the period on purchases and other inputs including acquisitions from the EU Output VAT is

Definition of input tax Entitlement to credit for input tax Power to make Treasury orders Supplies against which input tax is deductible Content of an invoice How and when input

What Is Input And Output Vat Uk have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: It is possible to tailor the design to meet your needs whether you're designing invitations planning your schedule or even decorating your home.

-

Educational Value: Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a valuable resource for educators and parents.

-

Affordability: immediate access a variety of designs and templates can save you time and energy.

Where to Find more What Is Input And Output Vat Uk

What Is Output And Input VAT Mirandus Accountants

What Is Output And Input VAT Mirandus Accountants

You can calculate input VAT by adding up the total amount of VAT incurred on purchases made by the business that relate to the provision of onward taxable supplies Below we look at how

Output tax is the value added tax you charge on your own goods or services If you have a VAT registered business you must add VAT to every taxable item on the invoice These sales could be to other businesses or

Since we've got your curiosity about What Is Input And Output Vat Uk Let's find out where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with What Is Input And Output Vat Uk for all needs.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing What Is Input And Output Vat Uk

Here are some inventive ways in order to maximize the use of What Is Input And Output Vat Uk:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is Input And Output Vat Uk are an abundance of creative and practical resources catering to different needs and interest. Their availability and versatility make them a valuable addition to both professional and personal life. Explore the many options that is What Is Input And Output Vat Uk today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is Input And Output Vat Uk truly for free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I use free printables for commercial use?

- It's determined by the specific conditions of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright concerns with What Is Input And Output Vat Uk?

- Some printables may come with restrictions concerning their use. Check the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home using an printer, or go to a local print shop to purchase better quality prints.

-

What program do I need to run printables free of charge?

- Most printables come in the PDF format, and can be opened using free software such as Adobe Reader.

Input Device And Output Devices StudyMuch

Difference Between Input And Output Devices Expose Times

Check more sample of What Is Input And Output Vat Uk below

Input Tax Vs Output Tax Nigelctzx

A Complete Guide To VAT Codes The Full List Tide Business

Input And Output Devices Of A Computer NollyTech

Goods And Services Tax GST In Singapore What Is It

Journal Entries Of VAT Accounting Education

Examples Of Output Devices

https://www.taxoo.co.uk › input-vat-output-vat

Input VAT is the VAT included in the price for VAT taxable goods or services you buy to use in your business Output VAT is the VAT you must charge when you sell goods

https://www.thevatpeople.co.uk › advice-support › ...

In basic terms in the UK input VAT is VAT that s incurred on goods or services you purchase in the course of making VATable supplies If your business is VAT registered you can

Input VAT is the VAT included in the price for VAT taxable goods or services you buy to use in your business Output VAT is the VAT you must charge when you sell goods

In basic terms in the UK input VAT is VAT that s incurred on goods or services you purchase in the course of making VATable supplies If your business is VAT registered you can

Goods And Services Tax GST In Singapore What Is It

A Complete Guide To VAT Codes The Full List Tide Business

Journal Entries Of VAT Accounting Education

Examples Of Output Devices

Determining The VAT Portion And VAT Input And Output YouTube

What Is The Difference Between Input VAT And Output VAT In The UAE

What Is The Difference Between Input VAT And Output VAT In The UAE

Input And Output Devices For A Computer Working Examples