In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed products hasn't decreased. For educational purposes and creative work, or simply to add personal touches to your area, What Is Input And Output Tax In Gst are now an essential source. With this guide, you'll dive into the world "What Is Input And Output Tax In Gst," exploring their purpose, where they are available, and how they can enhance various aspects of your life.

Get Latest What Is Input And Output Tax In Gst Below

What Is Input And Output Tax In Gst

What Is Input And Output Tax In Gst -

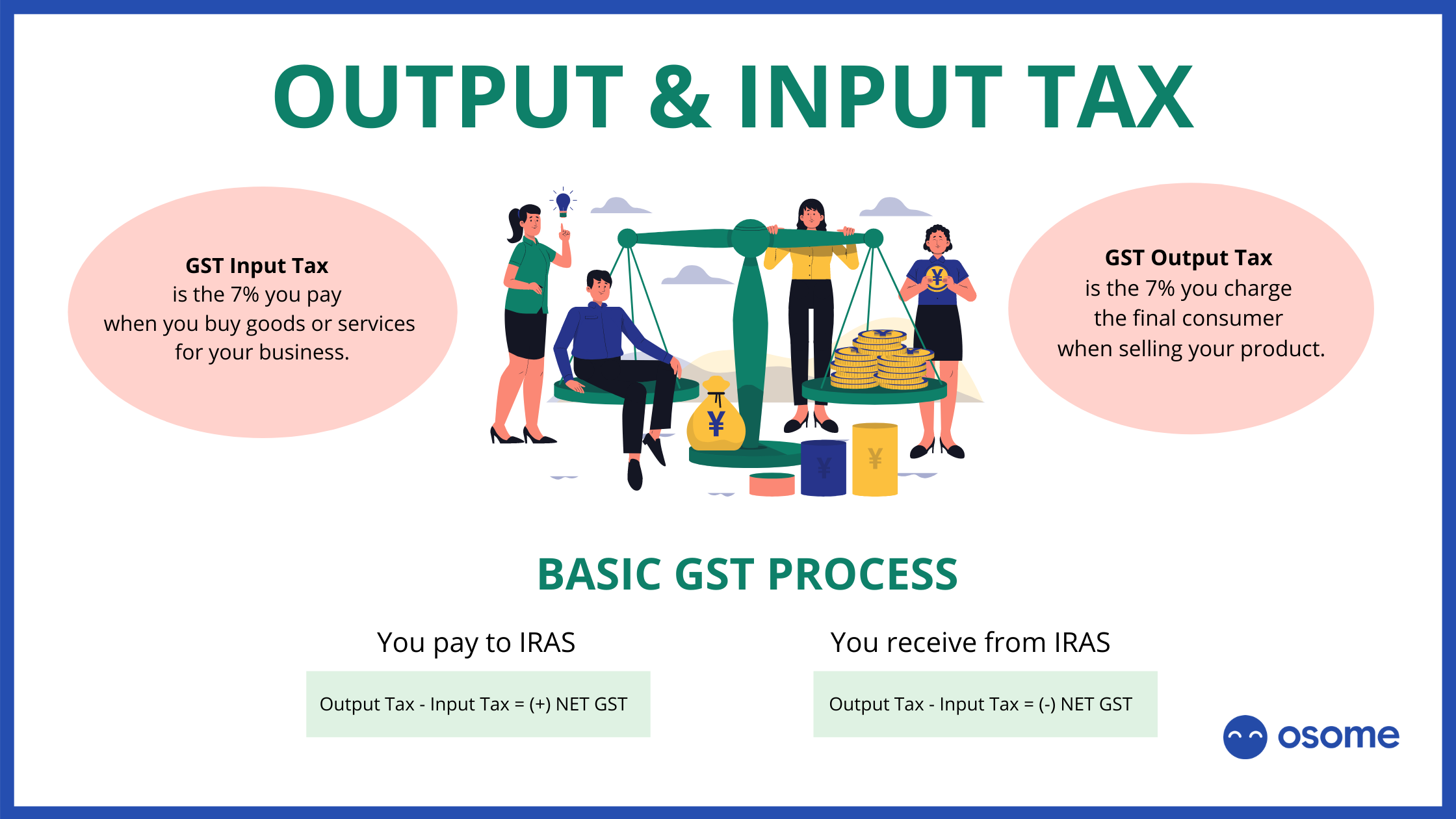

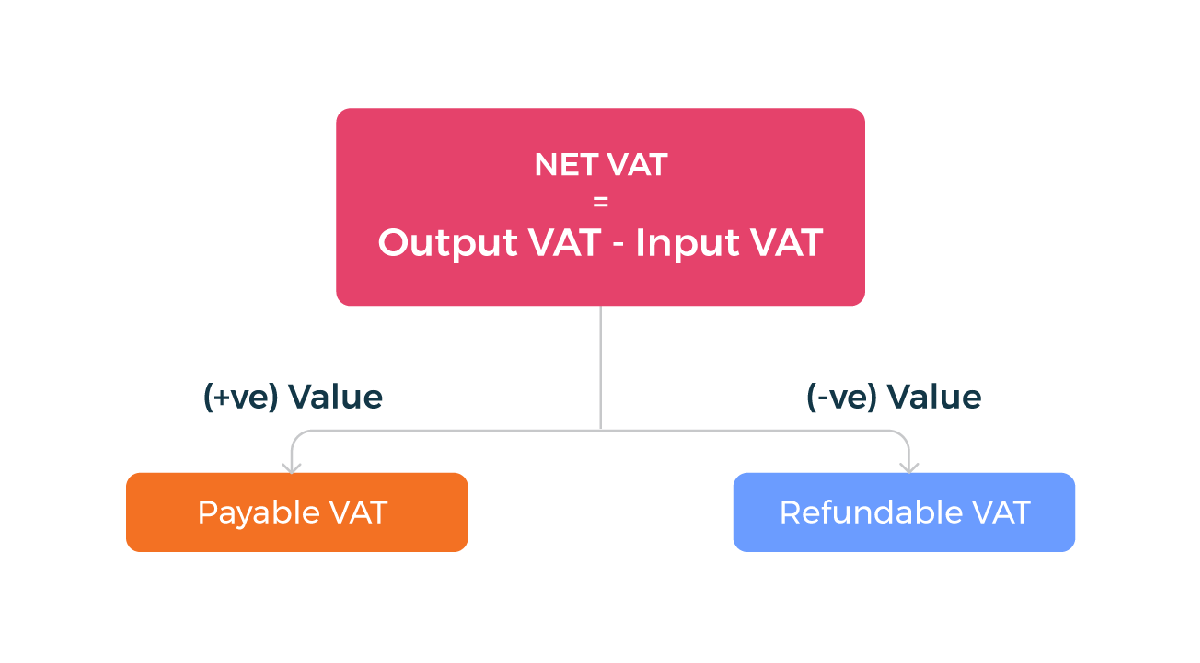

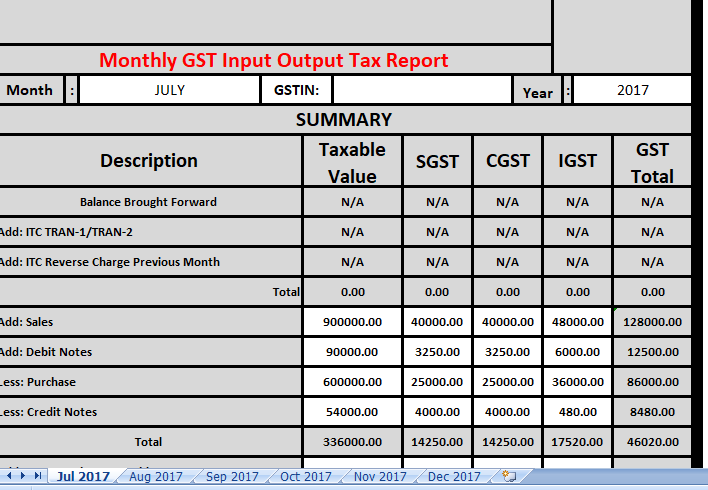

What is Output GST a GST on sales is called Output GST ea What is Input GST a GST on purchases is called Input GST ea What is GST Payable a Output G

In summary Output GST is the tax charged by a registered taxpayer on the supplies of goods and services whereas Input GST is the tax paid by a registered taxpayer

What Is Input And Output Tax In Gst include a broad assortment of printable content that can be downloaded from the internet at no cost. They come in many designs, including worksheets templates, coloring pages and more. The benefit of What Is Input And Output Tax In Gst lies in their versatility and accessibility.

More of What Is Input And Output Tax In Gst

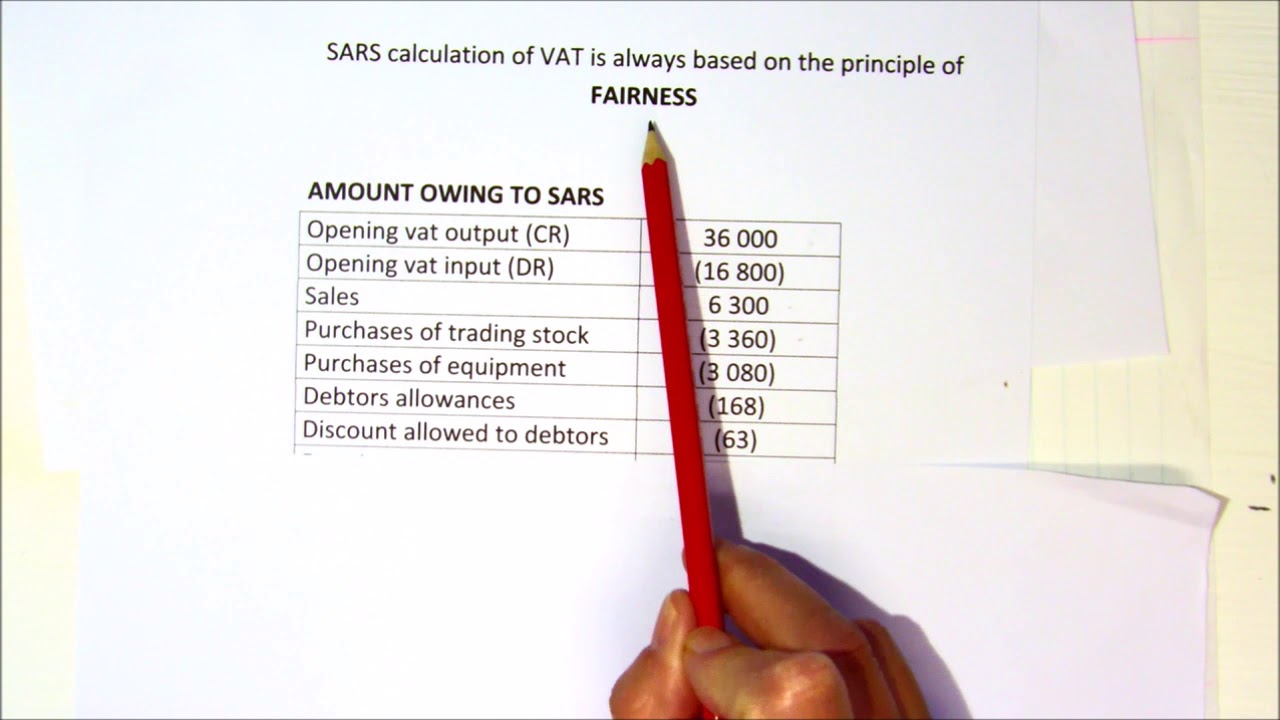

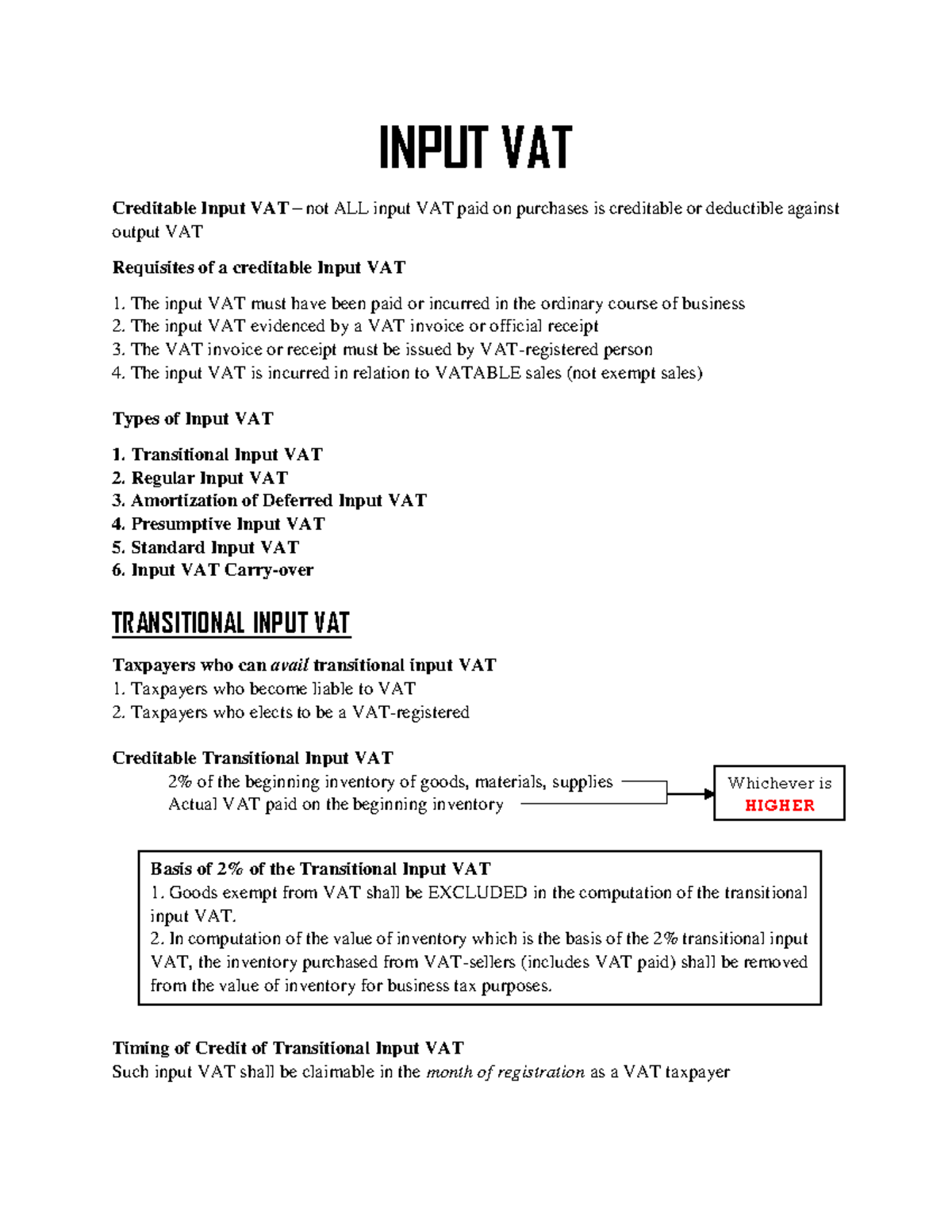

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

Notes Input VAT INPUT VAT Creditable Input VAT Not ALL Input VAT

Purpose Input tax credit reduces tax liability by crediting taxes already paid on inputs In contrast output tax liability is the tax owed on sales In contrast output tax liability is the tax

Learn about GST accounting and entries in India and how you must maintain your records for sales and purchase transactions from Zoho Books GST

What Is Input And Output Tax In Gst have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: They can make printed materials to meet your requirements whether it's making invitations, organizing your schedule, or even decorating your home.

-

Education Value These What Is Input And Output Tax In Gst offer a wide range of educational content for learners from all ages, making them a useful aid for parents as well as educators.

-

Convenience: Access to various designs and templates can save you time and energy.

Where to Find more What Is Input And Output Tax In Gst

Goods And Services Tax GST In Singapore What Is It

Goods And Services Tax GST In Singapore What Is It

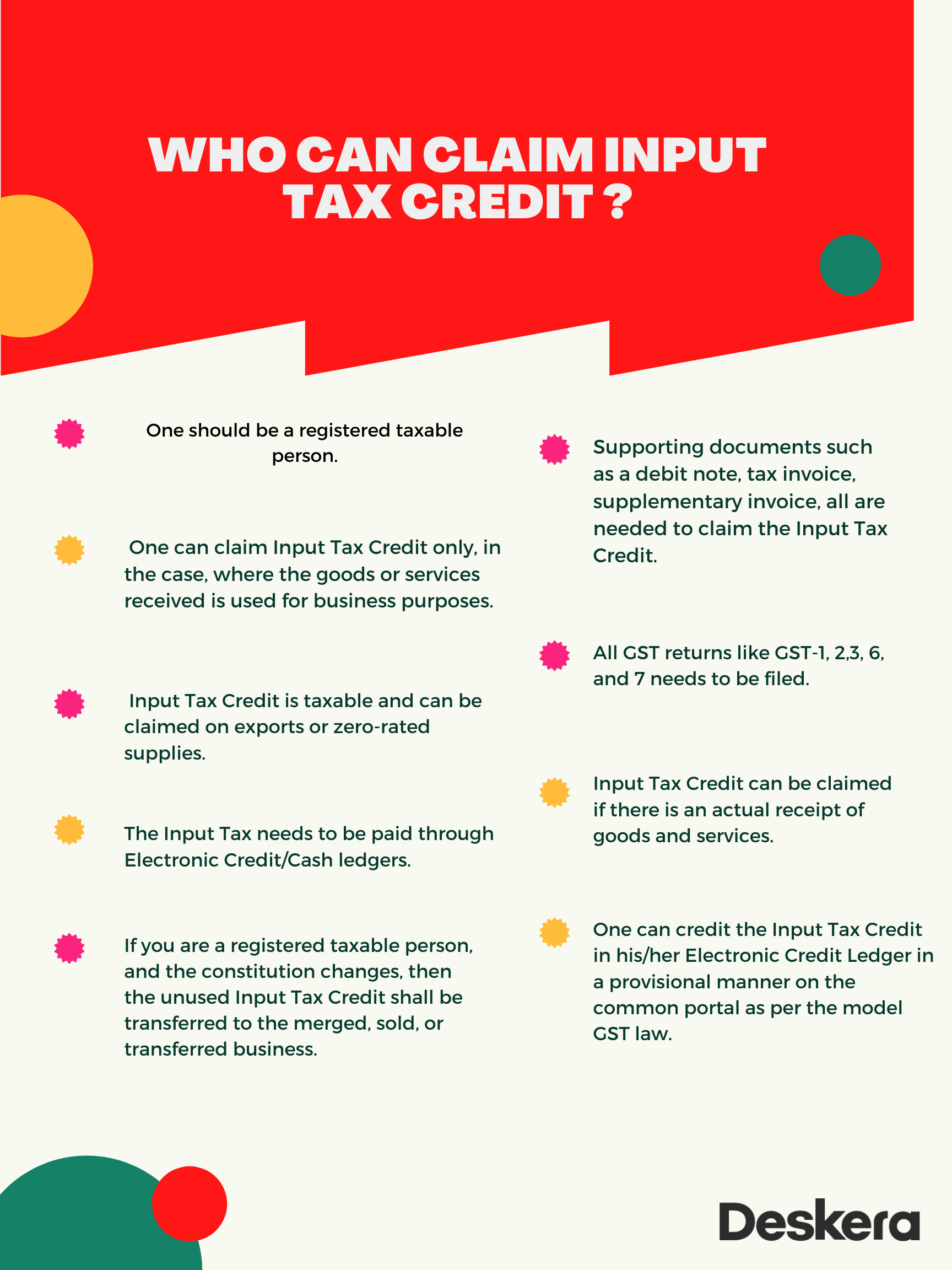

Input Tax Credit ITC allows businesses to reduce the tax they pay on their outputs by the amount of tax paid on their inputs It helps in avoiding the cascading effect of

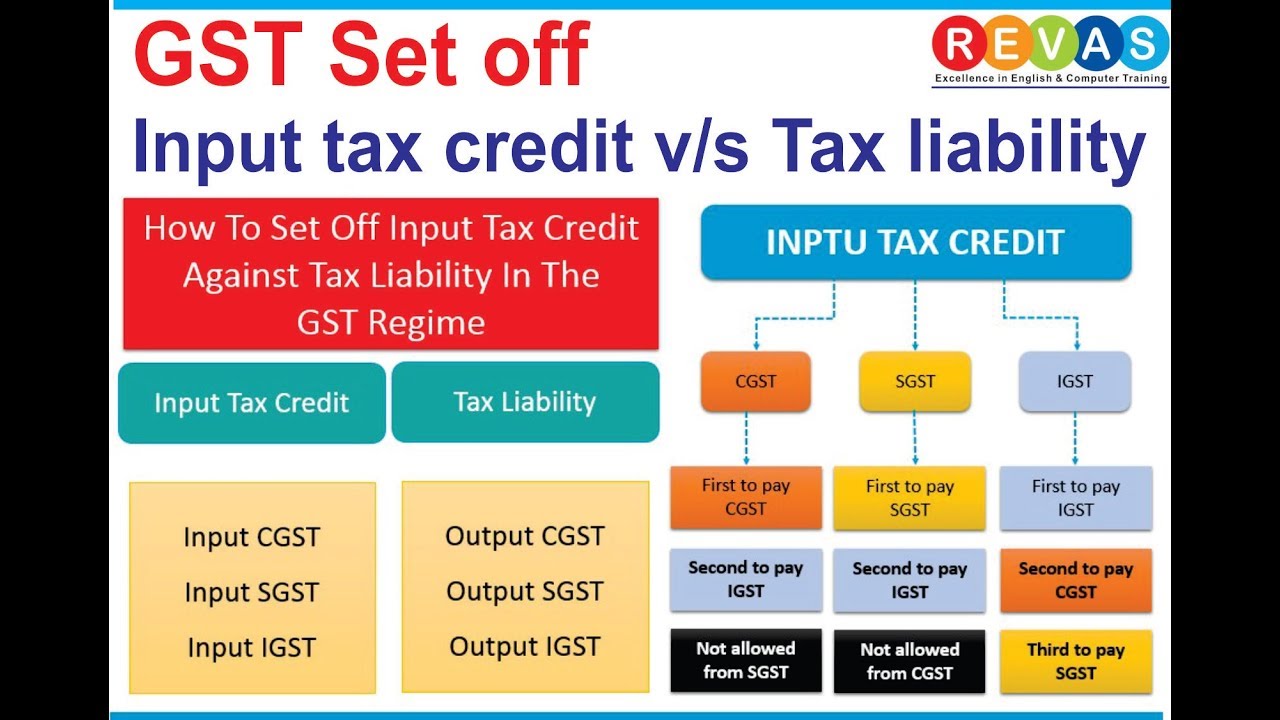

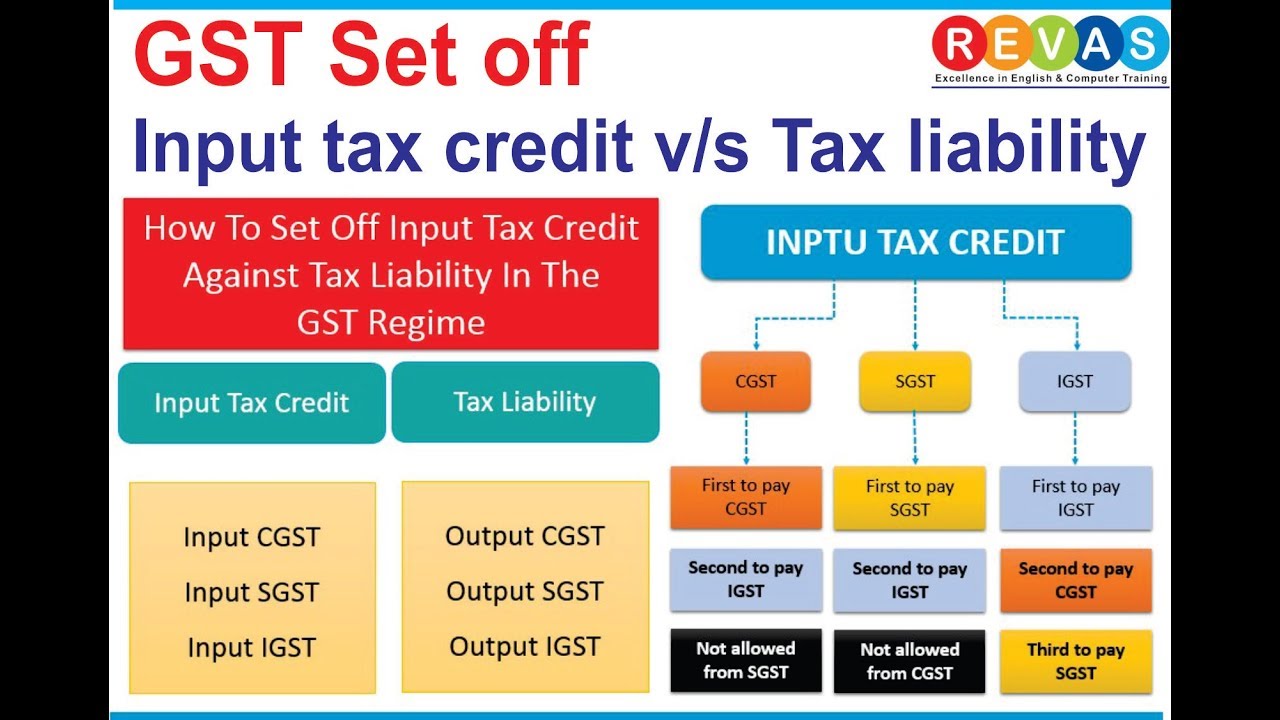

Output tax credit or output tax set off is a system in which businesses can set off the GST collected output tax against the GST paid input tax In other words it

Now that we've piqued your curiosity about What Is Input And Output Tax In Gst We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with What Is Input And Output Tax In Gst for all motives.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide range of interests, everything from DIY projects to planning a party.

Maximizing What Is Input And Output Tax In Gst

Here are some new ways ensure you get the very most of What Is Input And Output Tax In Gst:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is Input And Output Tax In Gst are an abundance of practical and imaginative resources which cater to a wide range of needs and preferences. Their accessibility and flexibility make them an essential part of each day life. Explore the endless world that is What Is Input And Output Tax In Gst today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can print and download these files for free.

-

Can I make use of free printouts for commercial usage?

- It's dependent on the particular rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with What Is Input And Output Tax In Gst?

- Certain printables could be restricted regarding usage. Always read the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer or go to an in-store print shop to get premium prints.

-

What program do I need to open printables for free?

- The majority of PDF documents are provided in the format PDF. This can be opened using free software like Adobe Reader.

ITC Rules Under GST 2021 Guide On Types Conditions Eligibility

Learn Accounting Entries Under GST With Journal Entry RCM Meteorio

Check more sample of What Is Input And Output Tax In Gst below

Input And Output Vat YouTube

Gst Set Off Rules

Input And Output Devices

Input GST Output GST Goods Service Tax GST In Accounts

Input Tax Credit Calculation Difference Case Entry GST Practical

Input Tax Vs Output Tax

https://www.helptax.in/learn/gst/what-is-output-gst-and-input-gst

In summary Output GST is the tax charged by a registered taxpayer on the supplies of goods and services whereas Input GST is the tax paid by a registered taxpayer

https://cleartax.in/s/gst-input-tax-credit

Input tax credit can be availed in GSTR 3B on or before the expiry of the timelimit defined by the GST law

In summary Output GST is the tax charged by a registered taxpayer on the supplies of goods and services whereas Input GST is the tax paid by a registered taxpayer

Input tax credit can be availed in GSTR 3B on or before the expiry of the timelimit defined by the GST law

Input GST Output GST Goods Service Tax GST In Accounts

Gst Set Off Rules

Input Tax Credit Calculation Difference Case Entry GST Practical

Input Tax Vs Output Tax

Input Credit Deductions And Refunds Zoho Books KSA

Guide To Maximizing The Utilization Of GST Input Tax Credit

Guide To Maximizing The Utilization Of GST Input Tax Credit

GST Input Output Tax Excel Template For Free