In this age of electronic devices, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. Be it for educational use such as creative projects or just adding the personal touch to your area, What Does Input And Output Tax Mean are now an essential resource. With this guide, you'll take a dive in the world of "What Does Input And Output Tax Mean," exploring the benefits of them, where they can be found, and how they can enhance various aspects of your life.

Get Latest What Does Input And Output Tax Mean Below

What Does Input And Output Tax Mean

What Does Input And Output Tax Mean -

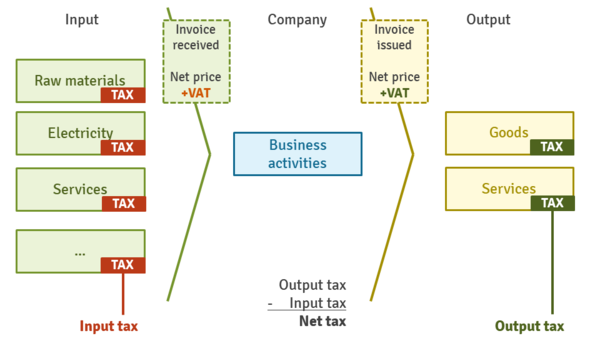

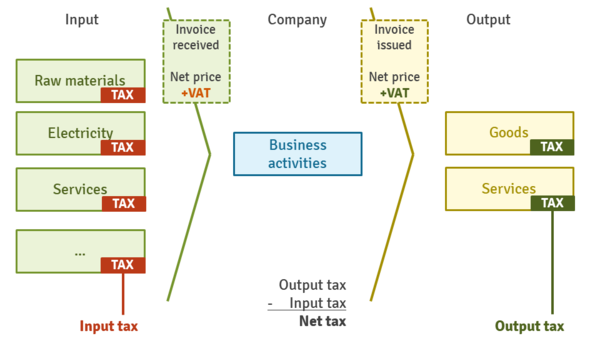

Input VAT refers to the tax you pay for the products or services you consume to run your business For instance you buy thread to stitch clothes for your business The amount of VAT you will pay for the thread

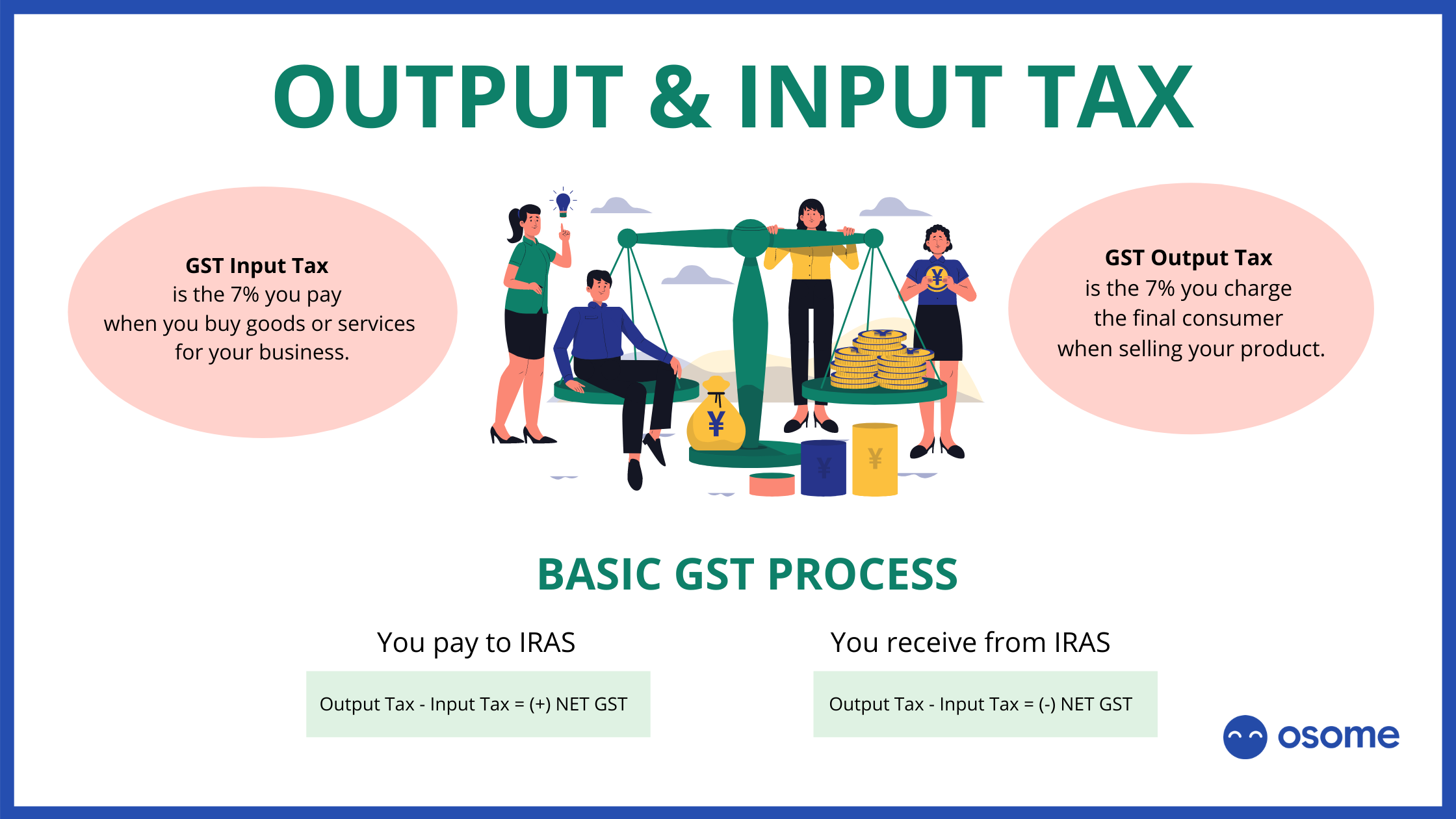

Input VAT is the value added tax added to the price of goods and services a business buys while output VAT is the value added tax that is charged on the sales of goods and services to consumers and businesses if the seller

Printables for free include a vast collection of printable materials available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and much more. The appeal of printables for free is in their variety and accessibility.

More of What Does Input And Output Tax Mean

Output Tax CEOpedia Management Online

Output Tax CEOpedia Management Online

Input VAT is the tax that your business pays on purchases and expenses It s called input because it is the tax on the goods and services that enter your business fueling your operations To calculate input VAT simply apply the

The main differences between input VAT and output VAT are in the nature of each case The input tax is an amount that the company is paying while the repercussion refers to the collections it is making

What Does Input And Output Tax Mean have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: They can make the templates to meet your individual needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them a valuable aid for parents as well as educators.

-

It's easy: Access to a plethora of designs and templates saves time and effort.

Where to Find more What Does Input And Output Tax Mean

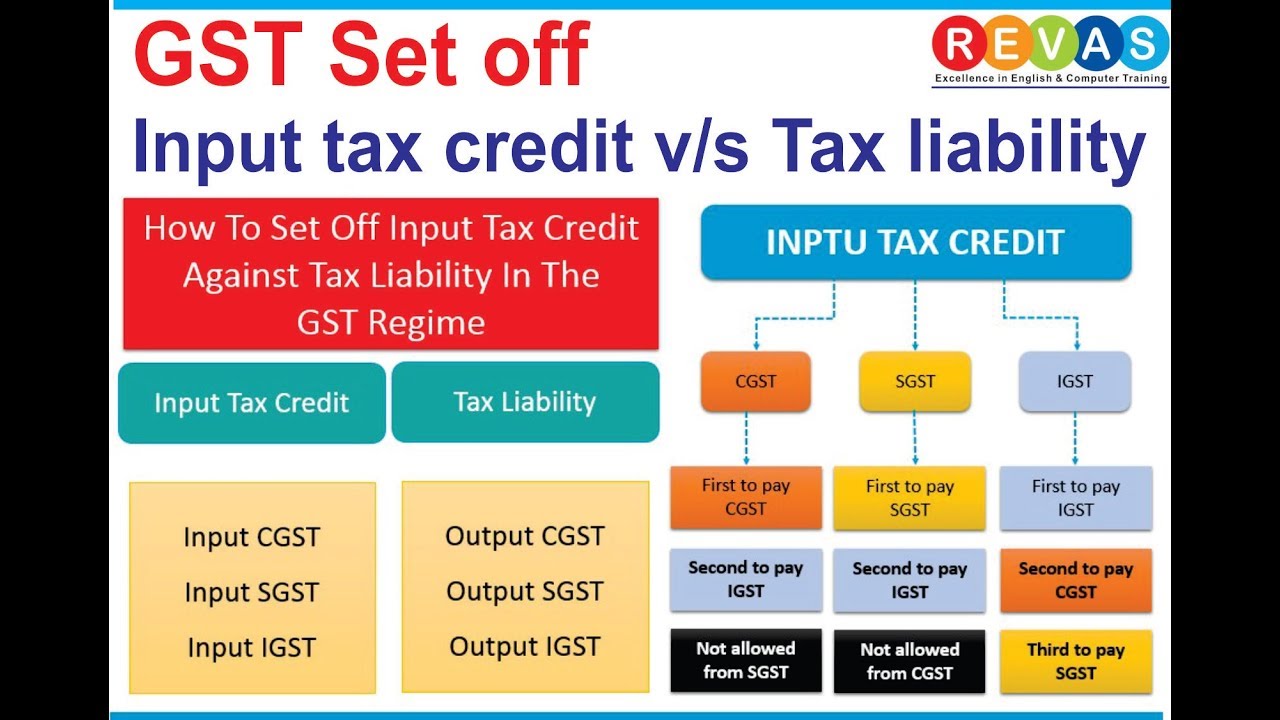

Gst Input And Output GST Input Tax Credit Under Revised Model GST Law

Gst Input And Output GST Input Tax Credit Under Revised Model GST Law

Our input and output VAT guide explains and how they are both reflected in your accounts and the fundamentals needed to meet the making tax digital for VAT requirements What is input

Output VAT and input VAT There are several important points regarding output VAT and input VAT which should be remembered For VAT purposes there is no distinction between revenue

Now that we've ignited your interest in What Does Input And Output Tax Mean Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of What Does Input And Output Tax Mean to suit a variety of reasons.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning materials.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide range of interests, that range from DIY projects to party planning.

Maximizing What Does Input And Output Tax Mean

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

What Does Input And Output Tax Mean are a treasure trove filled with creative and practical information designed to meet a range of needs and hobbies. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the world of What Does Input And Output Tax Mean today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can download and print these files for free.

-

Can I use free printouts for commercial usage?

- It depends on the specific usage guidelines. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using What Does Input And Output Tax Mean?

- Certain printables may be subject to restrictions on their use. Be sure to read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to the local print shops for high-quality prints.

-

What software do I need to open printables for free?

- A majority of printed materials are in the format PDF. This is open with no cost software like Adobe Reader.

How Does Gst Works Output Tax Input Tax Transparent PNG 1422x501

What Does Input Tax Mean

Check more sample of What Does Input And Output Tax Mean below

Goods And Services Tax GST In Singapore What Is It

What Is Input Tax And Output VAT

Guide To Maximizing The Utilization Of GST Input Tax Credit

Input Tax Credit Guide Under GST Calculation With Examples

Input Tax Credit Calculation Difference Case Entry GST Practical

What Does Input Tax Mean YouTube

https://www.taxually.com/blog/input-vat …

Input VAT is the value added tax added to the price of goods and services a business buys while output VAT is the value added tax that is charged on the sales of goods and services to consumers and businesses if the seller

https://marosavat.com/what-is-input-va…

When talking about what input VAT is it is defined as the VAT applied to company purchases of goods or services by your business Essentially this is VAT that was already paid by your business on those transactions and can

Input VAT is the value added tax added to the price of goods and services a business buys while output VAT is the value added tax that is charged on the sales of goods and services to consumers and businesses if the seller

When talking about what input VAT is it is defined as the VAT applied to company purchases of goods or services by your business Essentially this is VAT that was already paid by your business on those transactions and can

Input Tax Credit Guide Under GST Calculation With Examples

What Is Input Tax And Output VAT

Input Tax Credit Calculation Difference Case Entry GST Practical

What Does Input Tax Mean YouTube

Input Tax Vs Output Tax Chapter 4 Types Of Supplies Supraisess

Important Points Of Input Tax Credit In GST Input Tax Credit In GST

Important Points Of Input Tax Credit In GST Input Tax Credit In GST

VAT Partial Exemption Everything You Need To Know Tide Business