In this day and age where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. For educational purposes, creative projects, or simply to add an individual touch to the space, What Is A Straight Line Depreciation Definition are now an essential resource. This article will dive deeper into "What Is A Straight Line Depreciation Definition," exploring the different types of printables, where they can be found, and what they can do to improve different aspects of your daily life.

Get Latest What Is A Straight Line Depreciation Definition Below

:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg)

What Is A Straight Line Depreciation Definition

What Is A Straight Line Depreciation Definition -

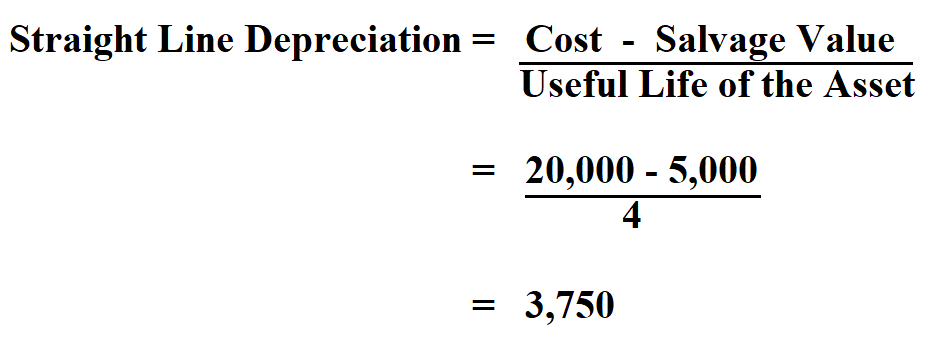

With straight line depreciation an asset s cost is depreciated the same amount for each accounting period You can then depreciate key assets on your tax income statement or business balance sheet This method was

The straight line depreciation method is a common way to measure the depreciation of a fixed asset over time The method can help you predict your expenses know when it s time for a new investment and prepare

Printables for free include a vast collection of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and many more. The great thing about What Is A Straight Line Depreciation Definition is their flexibility and accessibility.

More of What Is A Straight Line Depreciation Definition

Straight Line Depreciation Method Definition Examples Online Accounting

Straight Line Depreciation Method Definition Examples Online Accounting

What is Straight Line Depreciation Straight line depreciation is the default method used to recognize the carrying amount of a fixed asset evenly over its useful life It is

The default method used to gradually reduce the carrying amount of a fixed asset over its useful life is called Straight Line Depreciation Accounting rules dictate that expenses and sales are matched in the period in

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: There is the possibility of tailoring printed materials to meet your requirements whether you're designing invitations making your schedule, or decorating your home.

-

Educational Use: The free educational worksheets cater to learners of all ages. This makes them a valuable source for educators and parents.

-

Affordability: The instant accessibility to a variety of designs and templates, which saves time as well as effort.

Where to Find more What Is A Straight Line Depreciation Definition

Straight Line Depreciation Definition Formula Examples Journal Entries

Straight Line Depreciation Definition Formula Examples Journal Entries

Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset Depreciation can be calculated using the straight

What is the Straight Line Basis The straight line basis is a method used to determine an asset s rate of reduction in value over its useful lifespan Other common methods used to calculate depreciation expenses of fixed assets are

We hope we've stimulated your curiosity about What Is A Straight Line Depreciation Definition Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in What Is A Straight Line Depreciation Definition for different needs.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast spectrum of interests, starting from DIY projects to planning a party.

Maximizing What Is A Straight Line Depreciation Definition

Here are some new ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

What Is A Straight Line Depreciation Definition are a treasure trove of creative and practical resources that meet a variety of needs and preferences. Their access and versatility makes them a valuable addition to your professional and personal life. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can print and download these materials for free.

-

Can I use the free printouts for commercial usage?

- It's determined by the specific conditions of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download What Is A Straight Line Depreciation Definition?

- Some printables may have restrictions in their usage. Be sure to review the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home with printing equipment or visit the local print shops for the highest quality prints.

-

What software do I need to open printables at no cost?

- Most PDF-based printables are available in PDF format, which is open with no cost software like Adobe Reader.

Depreciation Equation Calculator CallumYeshua

What Is Straight Line Depreciation Method PMP Exam YouTube

Check more sample of What Is A Straight Line Depreciation Definition below

Simple Depreciation Calculator AlissaDanil

Depreciation Definition And Types With Calculation Examples

:max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg)

What Is Straight Line Depreciation And Why Does It Matter Personal

Depreciation Expense Straight Line Method W Example Journal Entries

Straight Line Depreciation Formula Calculator

Straight Line Depreciation Definition

:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg?w=186)

https://quickbooks.intuit.com/r/account…

The straight line depreciation method is a common way to measure the depreciation of a fixed asset over time The method can help you predict your expenses know when it s time for a new investment and prepare

https://www.financestrategists.com/acco…

To use straight line depreciation determine the expected economic life of an asset Divide the number 1 by the number of years in the expected economic life This gives you a straight line depreciation rate For

The straight line depreciation method is a common way to measure the depreciation of a fixed asset over time The method can help you predict your expenses know when it s time for a new investment and prepare

To use straight line depreciation determine the expected economic life of an asset Divide the number 1 by the number of years in the expected economic life This gives you a straight line depreciation rate For

Depreciation Expense Straight Line Method W Example Journal Entries

:max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg)

Depreciation Definition And Types With Calculation Examples

Straight Line Depreciation Formula Calculator

Straight Line Depreciation Definition

Methods Of Depreciation Formulas Problems And Solutions Owlcation

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

Straight Line Depreciation Formula And Calculation